The GBP/USD currency pair traded lower on Friday, but the decline of the British pound remains relatively weak for now. Technically, an upward correction may still continue. While the euro is moving sideways, the pound is in an uptrend. Such a divergence between these two major currency pairs is unusual, but it stems from differing monetary policies of the Bank of England and the European Central Bank.

Despite the strong growth of the British pound in recent weeks, we expect a similar outcome for the pound as we do for the euro—a decline in the medium term. The pound's recent gains appear to be temporary, and the upward correction aligns with our earlier expectations. Meanwhile, the euro failed to achieve this upward move, and the pound has even exceeded some forecasts.

The British currency has been supported by mixed labor market and GDP reports. While these reports did not indicate strong positive figures, they were better than analysts' and traders' pessimistic predictions, leading to a perception of "positivity." However, there have been no significant improvements in the UK economy. Although the BoE is reducing rates at a slower pace than the ECB, this only provides a temporary reprieve, as the market has already accounted for the entire Fed easing cycle, but not for the BoE's actions.

This week, the UK will release only business activity indices for the services and manufacturing sectors, which are unlikely to affect the overall trend of the pair. If the correction has ended, the pound will decline regardless. The factors that could impact the pair's movement include significant reports on unemployment, the labor market, and business activity in the U.S. The first week of each month typically brings ISM indices, Non-Farm Payrolls, and unemployment rate reports—these are the main reports, along with several secondary ones also scheduled. Another major consideration is how the market will react to developments at the White House on Friday.

From a macroeconomic perspective, next week's key reports are more likely to support the dollar than create pressure. ISM business activity indices are expected to remain almost unchanged. The unemployment rate has declined for two consecutive months and may remain stable in February. The Non-Farm Payrolls forecast is relatively low, making it easy to exceed expectations. While it's impossible to predict report figures with certainty, we would anticipate declines in both currency pairs if we had to make an early forecast.

On the daily timeframe, the pound has undergone a significant correction. Of course, the correction could continue for weeks or even months, as corrective movements always take longer than trends. However, at this stage, we would at least like to see a downward pullback. Therefore, we still expect GBP/USD to decline.

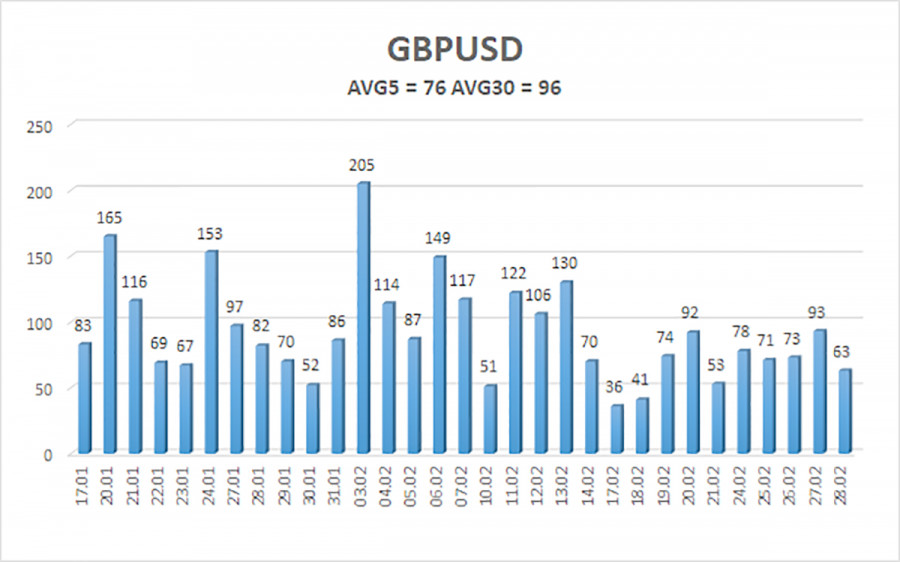

The average volatility of the GBP/USD pair over the last five trading days is 76 pips, which is classified as "moderate" for this pair. On Monday, March 3, we expect movement within the range of 1.2499 to 1.2651. The long-term regression channel remains downward, signaling a bearish trend. The CCI indicator entered the overbought zone, warning of a potential decline.

Nearest Support Levels:

S1 – 1.2573

S2 – 1.2512

S3 – 1.2451

Nearest Resistance Levels:

R1 – 1.2634

R2 – 1.2695

R3 – 1.2756

Trading Recommendations:

The GBP/USD currency pair maintains a medium-term downtrend. We are still not considering long positions, as we believe the current upward movement is merely a correction. If you trade purely based on technicals, long positions are possible, with targets at 1.2695 and 1.2756 if the price consolidates above the moving average. However, sell orders remain much more relevant, with targets at 1.2207 and 1.2146, as the upward correction on the daily timeframe will eventually end. The British pound already appears locally overbought and began to decline last week.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.