#AAPL (Apple Inc.). Exchange rate and online charts

Currency converter

02 Apr 2025 21:15

(-3.62%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Apple Inc. is the American IT-giant and the most expensive company in the world. Its capitalization exceeds $450 billion and the brand value according to different estimates reaches $98 to $185 billion. The company was established in early 70’s in California by Steve Jobs and Steve Wozniak, and first registered on April 1, 1976. The IPO was launched on December 12, 1980. In total, 4.6 bln securities were sold at the initial cost of $3.6. Until 2004 the share price did not go over $40. However, after the company refocused on the mobile devices, the share price has multiplied by 6 times. Moreover, after the release of the iPad, the shares of Apple Inc. surged to the mark of $700. Now the asset turnover is about 900 billion and the unit price fluctuates around $500.

Apple Inc. share price has been growing by approximately 16.1% for the last three years. The dividend yield equals 2.23% and EPS 42% a year. Cost of securities is directly bound to the quarterly reports and new devices releases. The main income of Apple Inc. is constituted by expanding iPhone sales, which comprise about 67% of gross income. Consequently, the company’s share value is much influenced by the success of new Apple smartphones.

See Also

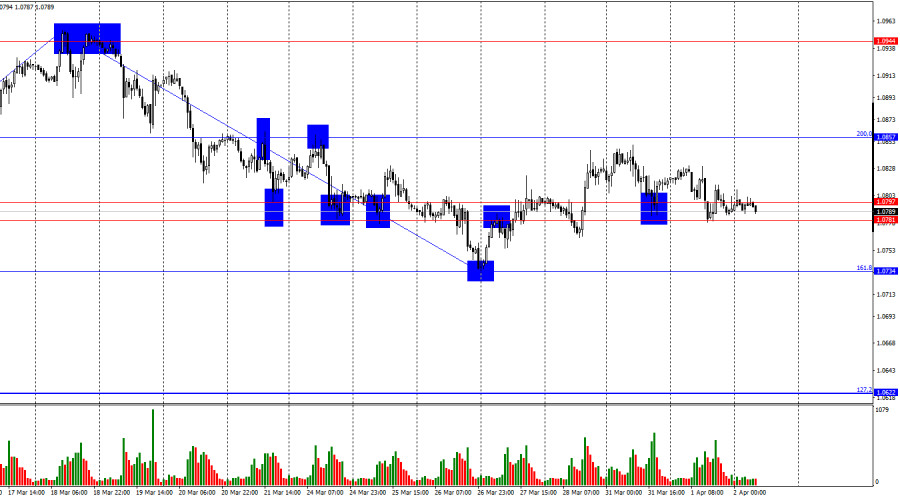

- Forecast for EUR/USD on April 2, 2025

Author: Samir Klishi

11:23 2025-04-02 UTC+2

1435

XAU/USD. Analysis and ForecastAuthor: Irina Yanina

13:22 2025-04-02 UTC+2

1345

Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin.Author: Sebastian Seliga

11:34 2025-04-02 UTC+2

1330

- Forecast

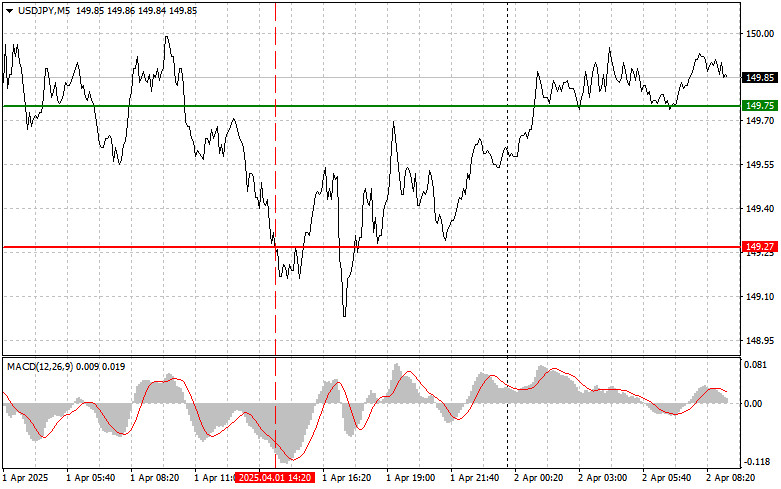

USD/JPY: Simple Trading Tips for Beginner Traders on April 2. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 2. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:50 2025-04-02 UTC+2

1330

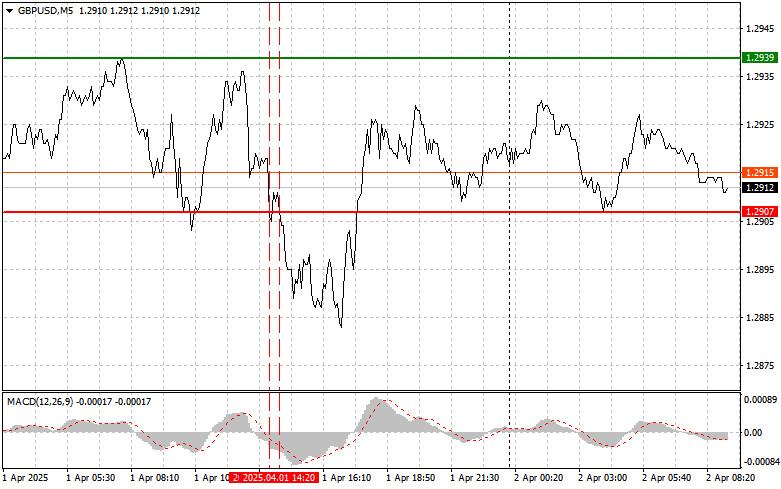

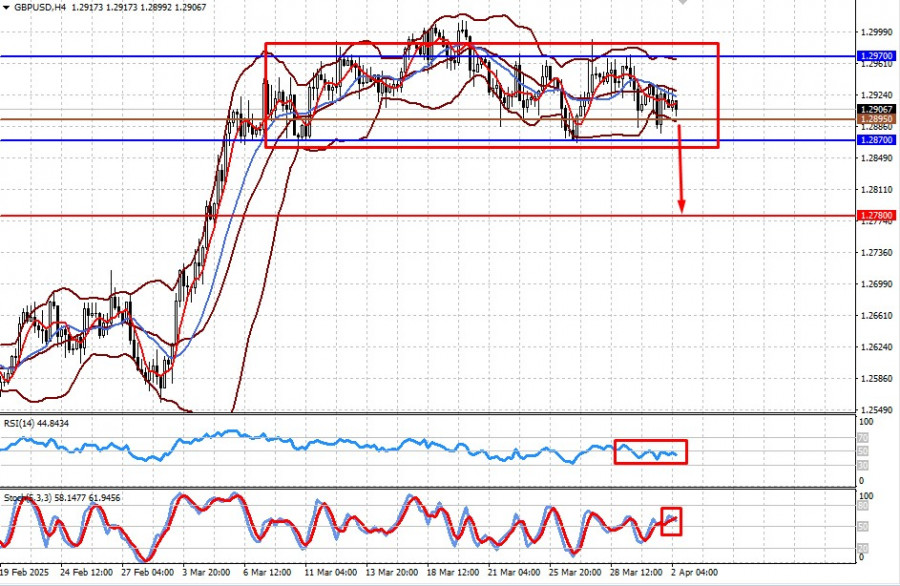

ForecastGBP/USD: Simple Trading Tips for Beginner Traders on April 2. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on April 2. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:50 2025-04-02 UTC+2

1315

Today, the AUD/USD pair is showing positive momentum, rebounding from nearly a four-week low.Author: Irina Yanina

12:25 2025-04-02 UTC+2

1300

- Today the USD/CAD pair is attempting to halt yesterday's decline, trying to hold above the 1.4300 level.

Author: Irina Yanina

12:22 2025-04-02 UTC+2

1270

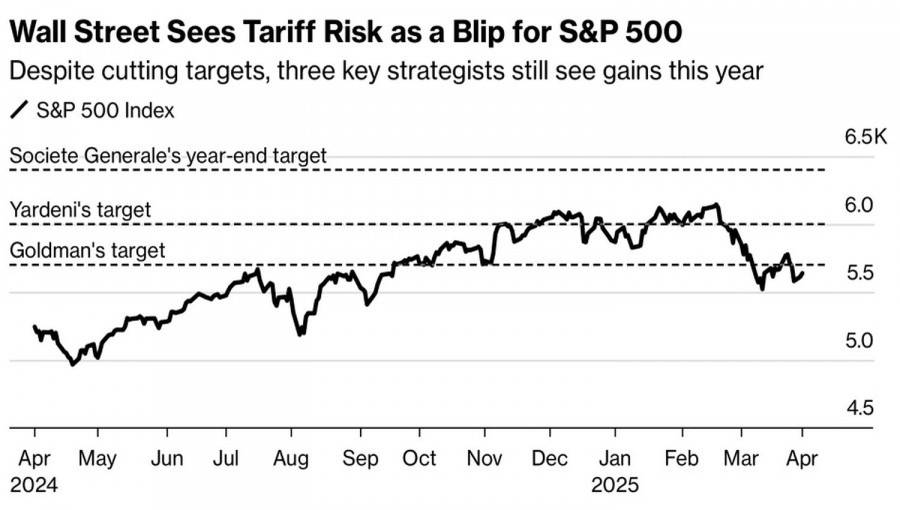

Fundamental analysisMarkets May React to New U.S. Tariffs with Growth—But Under One Condition... (GBP/USD Downside and USD/CAD Upside Possible)

The day Donald Trump declared "Liberation Day" has arrived. Markets are bracing for the U.S. to introduce comprehensive and large-scale tariffs on its trade partners and potential retaliatory measures from those countriesAuthor: Pati Gani

09:51 2025-04-02 UTC+2

1255

S&P 500's Calm Masks Underlying TensionAuthor: Marek Petkovich

09:16 2025-04-02 UTC+2

1210

- Forecast for EUR/USD on April 2, 2025

Author: Samir Klishi

11:23 2025-04-02 UTC+2

1435

- XAU/USD. Analysis and Forecast

Author: Irina Yanina

13:22 2025-04-02 UTC+2

1345

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin.

Author: Sebastian Seliga

11:34 2025-04-02 UTC+2

1330

- Forecast

USD/JPY: Simple Trading Tips for Beginner Traders on April 2. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 2. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:50 2025-04-02 UTC+2

1330

- Forecast

GBP/USD: Simple Trading Tips for Beginner Traders on April 2. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on April 2. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:50 2025-04-02 UTC+2

1315

- Today, the AUD/USD pair is showing positive momentum, rebounding from nearly a four-week low.

Author: Irina Yanina

12:25 2025-04-02 UTC+2

1300

- Today the USD/CAD pair is attempting to halt yesterday's decline, trying to hold above the 1.4300 level.

Author: Irina Yanina

12:22 2025-04-02 UTC+2

1270

- Fundamental analysis

Markets May React to New U.S. Tariffs with Growth—But Under One Condition... (GBP/USD Downside and USD/CAD Upside Possible)

The day Donald Trump declared "Liberation Day" has arrived. Markets are bracing for the U.S. to introduce comprehensive and large-scale tariffs on its trade partners and potential retaliatory measures from those countriesAuthor: Pati Gani

09:51 2025-04-02 UTC+2

1255

- S&P 500's Calm Masks Underlying Tension

Author: Marek Petkovich

09:16 2025-04-02 UTC+2

1210