In my morning forecast, I highlighted the 1.0390 level as a key entry point. However, due to low volatility, the pair did not reach this level for a false breakout formation, leaving me without trades. The technical outlook for the second half of the day remains unchanged.

Buying Strategy for EUR/USD

The weaker-than-expected Q4 GDP data for the eurozone exerted some pressure on the euro, but since many market participants had already anticipated this outcome, no major sell-off followed. Now, the market's reaction to the ECB's decision will be crucial. However, traders should also focus on U.S. economic data, including Q4 U.S. GDP growth and Initial Jobless Claims. A strong GDP reading exceeding forecasts could strengthen the U.S. dollar, while disappointing data might trigger renewed buying in EUR/USD.

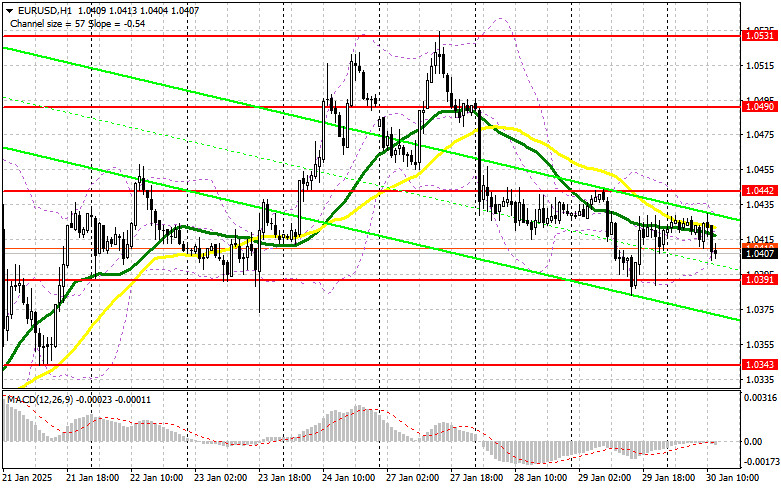

If the market reacts negatively to the ECB's decision and U.S. data, I will look for buying opportunities near the 1.0391 support level, which was formed yesterday. A false breakout at 1.0391 would provide a good entry point for long positions, targeting the 1.0442 resistance level. A break and retest of 1.0442 from above would confirm further bullish momentum, aiming for 1.0490, marking a strong counterattack by euro buyers. The final target will be 1.0531, where I will take profits.

However, if EUR/USD continues to decline and fails to hold at 1.0391, it could invalidate bullish prospects for the near term. In this case, sellers could push the pair down to 1.0343. Only a false breakout at 1.0343 would justify opening long positions. If the decline extends further, I will consider buying from 1.0311 for an intraday correction of 30-35 points.

Selling Strategy for EUR/USD

Sellers are once again targeting the 1.0391 support level, suggesting that the most interesting moves are still ahead. If traders react positively to ECB President Christine Lagarde's statements, the 1.0442 resistance level will be critical in determining EUR/USD's next direction. A false breakout at 1.0442 would signal that large sellers remain active, providing a short entry opportunity with a target at 1.0391. A break and retest of 1.0391 from below would confirm further bearish momentum, leading to 1.0343. The final bearish target will be 1.0311, where I will take profits.

If EUR/USD rises in the second half of the day and sellers fail to act at 1.0442, I will postpone short positions until 1.0490 (next resistance). A false breakout at 1.0490 would provide a selling opportunity. If bullish momentum persists, I will consider selling from 1.0531, targeting a 30-35 pip correction.

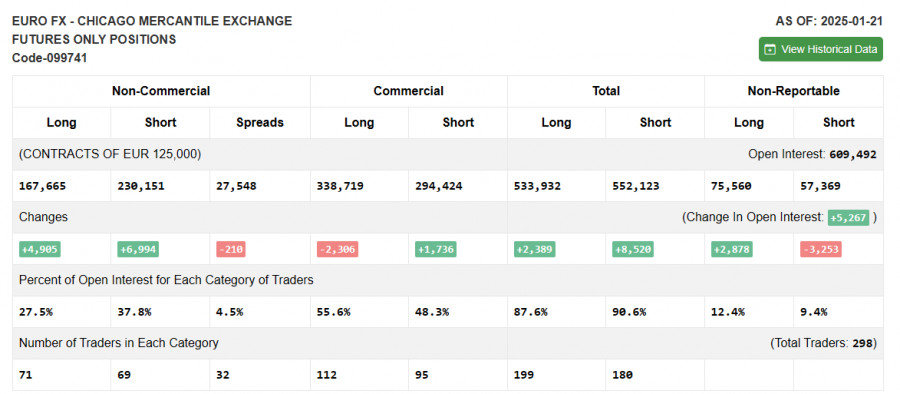

COT Report (Commitments of Traders – January 21)

The latest COT data shows increases in both long and short positions, but overall market positioning remains bearish. Traders continue favoring short positions on EUR/USD, expecting that Trump's policies will eventually strengthen the U.S. dollar. The uncertainty surrounding the Federal Reserve's future policy also adds to market caution. Long non-commercial positions increased by 4,905, reaching 167,665. Short non-commercial positions surged by 6,994, totaling 230,151. As a result, the gap between long and short positions narrowed by 210.

Indicator Signals for EUR/USD

Moving Averages

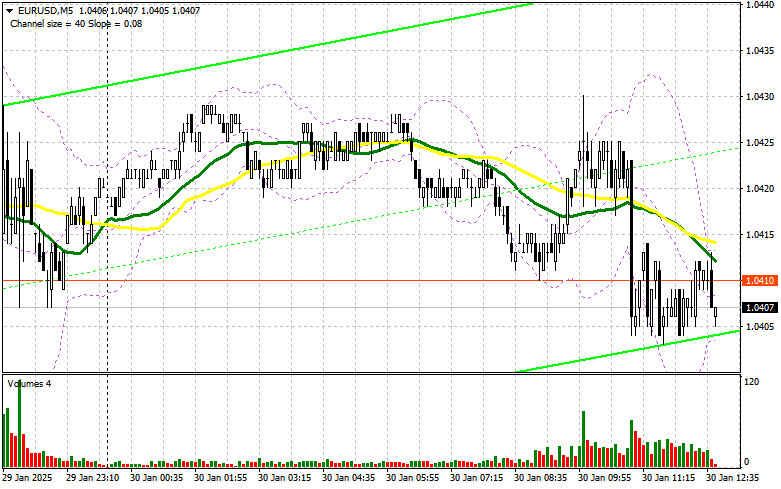

The pair is trading below the 30-day and 50-day moving averages, indicating continued pressure on the euro.

Note: The author uses hourly (H1) moving averages, which differ from the standard daily (D1) moving averages.

Bollinger Bands

If EUR/USD declines, the lower Bollinger Band near 1.0390 will act as support.

Indicator Descriptions

Moving Averages (MA):

- 50-period moving average – Identifies the current trend by smoothing out volatility and noise. Marked yellow on the chart.

- 30-period moving average – Provides an additional trend indication. Marked green on the chart.

MACD (Moving Average Convergence/Divergence):

- Fast EMA: 12-period.

- Slow EMA: 26-period.

- Signal Line (SMA): 9-period.

- Used to identify trend direction and momentum shifts.

Bollinger Bands:

- Period: 20.

- Helps determine volatility and potential support/resistance levels.

Non-Commercial Traders:

- Includes speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

Position Data:

- Long Non-Commercial Positions: Represents the total long (buy) open interest among non-commercial traders.

- Short Non-Commercial Positions: Represents the total short (sell) open interest among non-commercial traders.

- Net Non-Commercial Position: The difference between short and long positions, indicating overall market sentiment.