The EUR/USD currency pair traded much more calmly on Tuesday. That's no surprise—the market has already reacted to all the news about tariffs and counter-tariffs, and the actual implementation date no longer carries much weight. The market has settled somewhere between the 1.09 and 1.10 levels, although it's too early to speak of complete stabilization. More likely, this is just the calm before the next storm. After all, no one doubts that Trump will go all the way. And what does he have to lose? The U.S. president is 78 years old. Maybe he dreams of running for a third term, but during Biden's entire presidency, Trump repeatedly called him "old and sick." In four years, Trump himself will be 82.

Trump left the White House amid a scandal four years ago, and even then, he hadn't yet had time to truly "mess things up." Does anyone seriously believe that Americans will willingly vote for Trump again in four years? Or for any Republican who might hand over power to Trump within a week? In 2020, Americans were ready to vote for anyone but Trump. In 2028, they may be prepared to vote for Darth Vader or Spider-Man if the country keeps heading down this road.

We're still shocked that Trump managed to win a second term. Then again, Americans have only themselves to blame. They didn't like Biden—fine, here's Trump again. Stock markets are in freefall, the dollar is depreciating rapidly, and America is feuding with half the world. And this is just after three months of Trump's presidency.

A separate note must be made regarding another key figure in the current chaos—Elon Musk. During the election campaign, he was frequently seen alongside Trump and even landed a position in the White House. But here's the problem—once Trump started implementing tariffs, Tesla's shares nosedived, and global sales dropped to record lows. What's more, Americans themselves are now protesting against Musk, torching his cars and defacing his factories and showrooms. Musk has gone from being a legend and idol to a national pariah.

And once the billionaire realized things would only worsen, he started speaking out against Trump's trade policy. Of course, when tariffs targeted the entire automotive sector, Musk was riding high, already imagining billions in added revenue from Tesla sales. But within a month, some countries' sales collapsed by 80–90%. Many consumers are now boycotting not only Musk's products but everything American.

However, as we've already said, Trump is unlikely to stop. He's already fired Musk from the White House to prevent him from interfering with "matters of national importance." Musk is now urging Trump to introduce zero tariffs with the European Union—after all, someone still has to buy Tesla EVs.

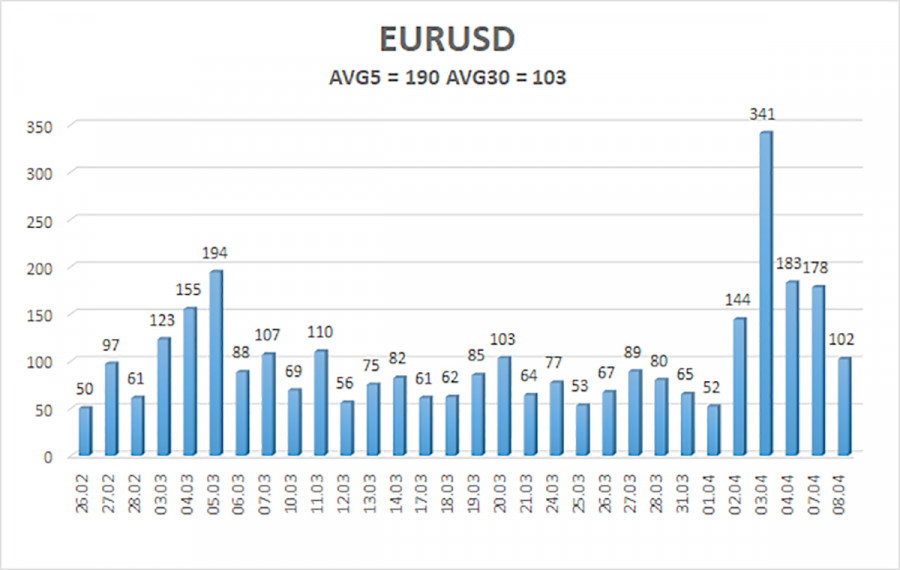

The average volatility of the EUR/USD currency pair over the last 5 trading days as of April 9 is 190 pips, categorized as "high." We expect the pair to move between the levels of 1.0717 and 1.1097 on Wednesday. The long-term regression channel is pointing upward, indicating a short-term uptrend. The CCI indicator entered the overbought zone, signaling a possible correction. However, the trend remains bullish for now.

Nearest Support Levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest Resistance Levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading Recommendations:

The EUR/USD pair maintains its upward trend. For months, we've said we expect a medium-term decline in the euro, and that forecast remains unchanged. The U.S. dollar, except Donald Trump, still has no fundamental reason for a medium-term decline. But that one reason alone continues to push the dollar into the abyss. It's a rare and unprecedented case for the currency market.

Short positions remain attractive with targets at 1.0315 and 1.0254, though it's extremely difficult to say when the "Trump-fueled" rally in the pair will end, or how many more tariffs and sanctions the U.S. president will announce. If you're trading based solely on technicals, long positions can be considered while the price remains above the moving average, with targets at 1.1097 and 1.1108.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.