Trade Analysis and Tips for Trading the British Pound

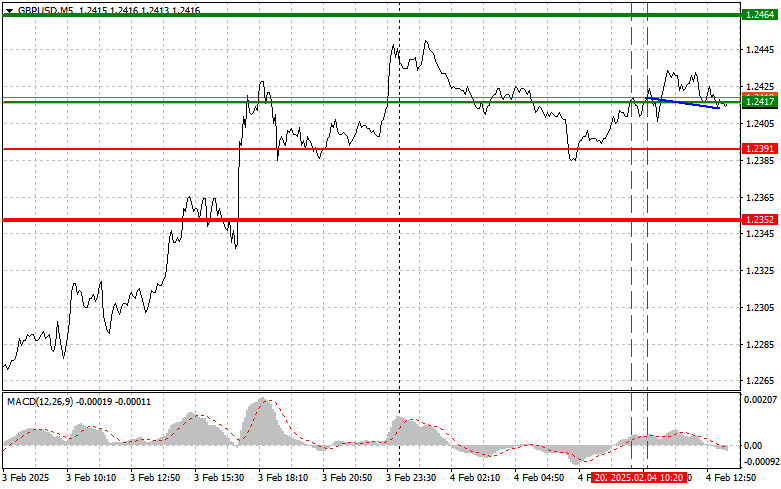

The first test of the 1.2417 price level occurred when the MACD indicator had already moved significantly above the zero line, clearly limiting the pair's upward potential. For this reason, I did not buy the pound. Shortly after, there was another test of 1.2417, which happened when the MACD was in the overbought zone. This allowed Scenario #2 for selling to play out. However, the pair did not experience a major decline, and trading remained around the 1.2417 level.

The increased interest in GBP/USD may be linked to positive news about the UK economy and expectations of interest rate cuts, which could stimulate economic growth. However, it's important to remember that in the long term, lower rates make the pound more vulnerable, so the growth effect might be short-lived. Nevertheless, as long as buyers maintain control, the likely scenario suggests a continued strengthening of the pound.

One of the key factors influencing the rise in GBP/USD is macroeconomic data. Today, we expect Job Openings and Labor Turnover data from the Bureau of Labor Statistics, Factory Orders figures, and Economic Optimism Index numbers from RCM/TIPP.

However, even more interesting will be statements from FOMC members Raphael Bostic and Mary Daly. Raphael Bostic, one of the most influential voices on the committee, has repeatedly emphasized the need for a flexible approach in light of the changing economic landscape. His comments often focus on balancing the needs of different segments of the economy, though this sometimes sparks debate among colleagues. Mary Daly, holding a similar position, frequently highlights the importance of considering the social implications of monetary policy. She stresses how interest rate changes may affect vulnerable populations. Their perspectives may intersect, offering valuable insights into the need for a more comprehensive analysis of monetary policy.

Intraday Strategy:

I will focus on the implementation of Scenarios #1 and #2 for today.

Buy Signal

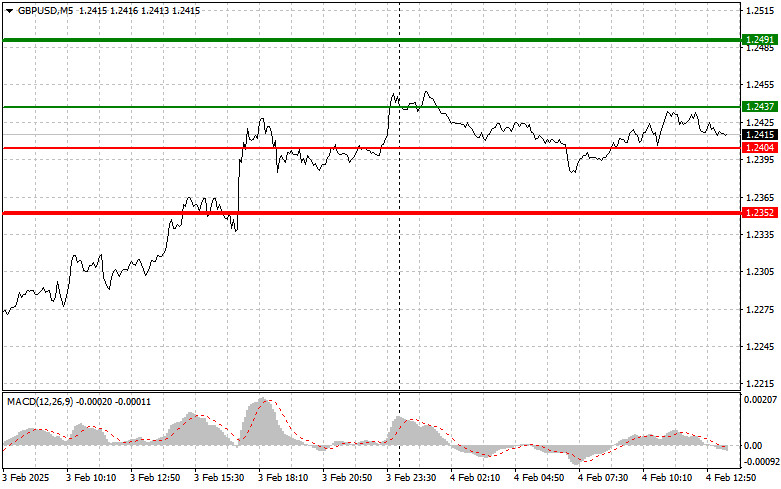

Scenario #1: I plan to buy the pound today if the entry point reaches the 1.2437 level (green line on the chart), targeting a rise to 1.2491 (thicker green line on the chart). At 1.2491, I will exit my buy positions and open sell positions in the opposite direction, expecting a 30-35 point pullback from that level. Pound growth today can only be expected after weak U.S. data.

Important! Before buying, ensure the MACD indicator is above the zero line and just starting to rise.

Scenario #2:I also plan to buy the pound today if the price tests 1.2404 twice in a row while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upwards. You can expect a rise toward the opposite levels of 1.2437 and 1.2491.

Sell Signal

Scenario #1: I plan to sell the pound today after the price drops below 1.2404 (red line on the chart), which would likely trigger a sharp decline in the pair. The key target for sellers will be 1.2352, where I plan to exit my sell positions and buy immediately in the opposite direction, expecting a 20-25 point retracement. Sellers will show themselves in the case of strong U.S. data.

Important! Before selling, ensure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the pound today if the price tests 1.2437 twice in a row while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downwards. You can expect a decline to the opposite levels of 1.2404 and 1.2352.

Chart Key:

- Thin green line – Entry price for buying the trading instrument.

- Thick green line – Approximate price where you can set Take Profit or manually lock in profits, as further growth above this level is unlikely.

- Thin red line – Entry price for selling the trading instrument.

- Thick red line – Approximate price where you can set Take Profit or manually lock in profits, as further decline below this level is unlikely.

- MACD Indicator – When entering the market, it is important to consider overbought and oversold zones.

Important Notice for Beginner Forex Traders:

- Be very cautious when making market entry decisions.

- Before major fundamental reports are released, it's best to stay out of the market to avoid sudden price swings.

- If you choose to trade during news releases, always set stop-loss orders to minimize losses.

- Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

For successful trading, it's essential to have a clear trading plan, like the one outlined above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for intraday traders.