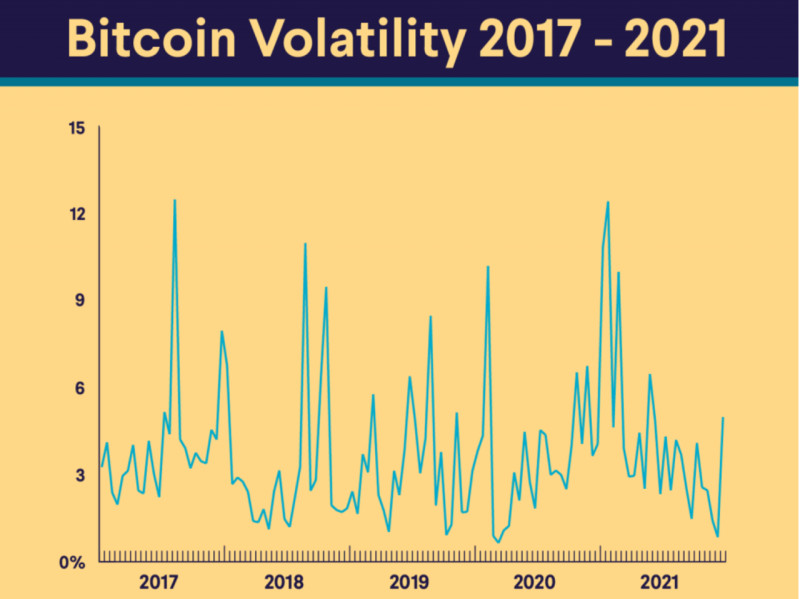

Why do many users distrust digital currencies? Digital currencies often appear in the news for their wild price swings—soaring one moment, crashing the next. This volatility makes users hesitant to invest their savings in them.

Why do new cryptocurrencies struggle to gain trust? Likewise, new cryptocurrencies frequently experience sharp price spikes and sudden crashes. Due to this instability, users fear losing their investments. Lots of inexperienced users believe that profits can only be made when crypto prices rise. However, this is not true—one can also earn during price declines.

This article explores how the crypto market behaves during downturns and what strategies to use in such periods. To learn more about digital currencies, how they enter the market, the types of digital assets, and ways to profit from new coins, check out our article New Cryptocurrencies.

Risks of investing in crypto

Digital currencies are an attractive tool for both trading and investing. Many users worldwide see high profit potential in a short period. However, investors must also be aware of the potential risks.

Several challenges may arise, including fraud and scams in crypto transactions, security risks associated with storing digital assets, extreme volatility, legal and regulatory concerns, etc.

Let’s examine these risks in detail. The first thing to discuss is fraud and scams in the crypto industry. Users often encounter fraud when buying or selling cryptocurrencies. To avoid this, it’s crucial to choose reliable trading platforms with a strong reputation for security. Some users avoid registering on exchanges because the identity verification process seems complicated. However, alternative platforms may lack the same security measures, increasing the risk of fraud.

Besides, the crypto market is full of scam projects, commonly known as "rug pulls". These fraudulent schemes involve fake websites and social media promotions to lure investors, only to disappear after collecting funds.

Storing cryptocurrencies: hot vs. cold wallets

After purchasing crypto, the next challenge is secure storage. There are two main types of crypto wallets:

- Hot wallets are connected to the internet, suitable for active trading, but less secure and

- Cold wallets are offline storage, more secure and ideal for long-term holding.

The most significant risk in crypto investing is high volatility. Prices can change rapidly, both upward and downward. To minimize risk, investors should only invest amounts they are prepared to lose.

Understanding crypto market corrections

The crypto market is highly interconnected—all assets influence each other. However, the most significant impact comes from Bitcoin's price movements.

When Bitcoin rises or falls, other cryptocurrencies often react more dramatically—either with stronger gains or sharper declines. This makes BTC the primary catalyst of market volatility.

What is a market correction? A correction occurs when an asset loses value over a short period, typically after a strong price surge. Once prices become too inflated, buying and selling activity balances out, causing the asset to return to a long-term trend. A correction is typically defined as a 10% drop from a peak price, though it can sometimes be even more significant.

What causes crypto corrections?

Multiple factors can trigger a market correction, including:

- Technical factors (overbought conditions, liquidity changes)

- Market sentiment (news, rumors, speculation)

- Regulatory updates (government policies, legal changes)

- Global political events

Oftentimes, corrections result from a combination of these factors.

The cycle of a market correction

During an extended bull run, an asset may become overvalued—meaning its price exceeds its real market value. When this happens, demand for the asset decreases, while supply increases. This imbalance triggers a price correction. Holders begin selling their crypto to secure profits. This first wave of selling encourages more investors to offload their holdings. Prices continue to decline until buying and selling stabilize. Understanding these patterns helps investors navigate crypto volatility and make informed trading decisions.

How to identify looming market crash

As mentioned earlier, there are several ways to detect a market correction. Each trader or investor chooses the method that suits them best to determine when a cryptocurrency price drop may begin. Below, we explore the most popular approaches to analyzing the current state of the crypto market.

Technical analysis using indicators

One of the most common approaches is technical analysis with indicators, which helps forecast price movements based on historical data and pattern recognition. The top indicators used for crypto analysis include:

- Trading volume. A decline in volume is a warning sign, indicating that the asset may be overvalued. If buyers hesitate to enter, while holders rush to sell, a price collapse is likely.

- RSI (Relative Strength Index) & Oscillators. These indicators help identify whether a cryptocurrency is overbought or oversold.

An RSI reading of 70 or higher signals an overbought market, suggesting that a price pullback or decline may follow.

- Fear and Greed Index ranges from 0 to 100, where:

0 represents extreme fear (investors panic-selling, leading to a crash).

100 represents extreme greed (overvaluation, followed by corrections).

Technical patterns & candlestick analysis

Some traders avoid using indicators, believing that price movements alone provide all necessary insights.

Chart patterns. Various price formations signal either a trend continuation or a trend reversal. If a bearish reversal pattern emerges during an uptrend, it often signals an imminent decline.

Candlestick analysis. Japanese candlestick patterns provide insights into trend continuation or reversals. Certain candlestick formations warn of potential corrections.

How to predict crypto market crash or rally

Aside from technical analysis, other methods can help anticipate a crypto downturn. These approaches are widely used by long-term investors.

Monitoring key news and events. Investors closely follow major news in finance, politics, and economics, as these factors significantly impact the crypto market. The most critical aspect is regulatory updates since many countries have yet to define crypto’s legal status. Some nations ban all crypto-related activities, while others permit only specific transactions.

Cryptocurrencies are classified differently:

- As a payment method

- As an investment asset

- As a taxable commodity

Regulatory changes directly influence price movements. Favorable laws encourage crypto adoption, leading to price increases. Stricter regulations create uncertainty, often causing price declines.

Examples. In 2021, after China banned crypto mining and transactions, Bitcoin’s price plunged 6–8% in just a few days. In 2022, as Hong Kong moved to legalize cryptocurrencies, their prices surged in response.

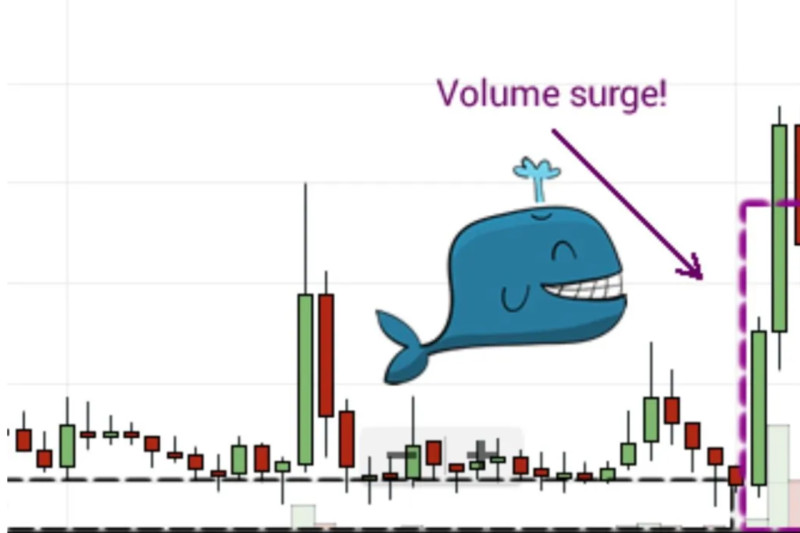

Tracking whale transactions

Crypto whales (large-scale investors holding vast amounts of digital assets) heavily influence the market. If whales begin transferring funds into another currency, this may signal an impending crash.

Large fund withdrawals from exchanges can trigger panic selling, leading to market declines.

How much can you lose in a crypto crash? Cryptocurrencies offer record-breaking profits but can also bring record-breaking losses.

Key risk factors:

- Extreme volatility. Prices can fluctuate wildly within hours or days.

- Bitcoin’s dominance. BTC’s price movements impact the entire crypto market, creating chain reactions.

Historical crypto market crashes

The Bitcoin crash occurred in 2011. A major exchange was hacked, causing BTC’s price to drop nearly 100% in one day. Nevertheless, Bitcoin quickly rebounded.

Another serious crypto market collapse happened in 2013. Following China’s ban on banks handling crypto transactions, Bitcoin fell from over $1,000 to $200 overnight. A long recovery phase followed.

These historical crashes show that while crypto markets are resilient, they remain highly volatile. Understanding market signals and risk management strategies is essential for investors.

Most significant crypto market crashes

A major crypto crash occurred at the end of 2017, when Bitcoin reached nearly $20,000, only to drop 29% to $13,800 within days. The decline continued into February 2018, bringing BTC below $7,000, and by the end of the year, it hit a low of $3,300—marking the first "crypto winter."

The next collapse happened in 2020, triggered by COVID-19 panic. On March 12, Bitcoin plunged 37% in a single day. However, once governments intervened to stabilize the global economy, both the stock market and crypto rebounded.

In 2021, after BTC hit an all-time high of $64,000, a sharp correction followed, cutting its price by over 50%. The reasons? China's ban on crypto mining and Tesla’s decision to stop accepting Bitcoin as payment. During this crash, global traders and investors lost $1.2 billion as Ethereum, Ripple, Dogecoin, and other major coins also plummeted. ETH fell to $2,800, XRP to $0.86, and DOGE dropped below $0.20.

In late 2022, the FTX exchange bankruptcy triggered another market-wide sell-off. As a result, Bitcoin lost 20% and Ethereum slumped 30%. Additionally, the Terra (LUNA) ecosystem collapsed, bringing its token’s price to nearly zero.

How to profit from crypto market crash

Many assume that profits can only be made when crypto prices rise, but traders can also profit from market downturns. Long-term investors rely solely on price appreciation, whereas traders can make money in both rising and falling markets through short-term strategies.

Experienced traders view every price movement—whether up or down—as an opportunity.

- Going long is buying assets in anticipation of price increases.

- Going short is selling assets expecting a price decline.

The larger the crash, the greater the profit potential.

How short-selling works

A trader borrows crypto from a broker. They immediately sell it, expecting the price to drop. Later, they buy it back at a lower price and return it to the broker. The price difference becomes their profit. However, if the trade goes wrong and prices rise instead, the trader must buy back at a higher price—resulting in losses.

Why short-selling is risky

Misjudging the market can lead to significant losses. Short selling is recommended only for experienced traders who understand market behavior and risk management strategies.

How to navigate a crypto market crash

Now that we’ve discussed how market crashes occur, let’s focus on how to act during these periods to minimize risks and protect investments.

A bear market is different from a simple correction:

- A 20%+ decline from previous highs

- A slowing economy and rising investor skepticism

- Robust short-selling activity

Trading vs. investing: key differences

| Parameter | Trading | Investing |

| Holding period | Minutes to weeks | Years or longer |

| Daily monitoring | Required | Not required |

| Income frequency | Daily | Quarterly to yearly |

| Profit potential | From rising and falling prices | Only from price appreciation |

Investor strategies for bear markets

1. Portfolio diversification. Never invest everything in a single asset. Some investors allocate only a portion of their funds to crypto.

2. Buying the dip. Bear markets offer the best buying opportunities. Investors seek strong assets that are likely to recover and grow.

3. Passive income options. Some cryptocurrencies offer staking and lending, allowing investors to earn regardless of market conditions.

Conclusion

Crypto market crashes happen now and then. Understanding how to anticipate them and how to act is crucial for every investor and trader.

Key takeaways:

Predicting crashes is possible using technical indicators, news monitoring, and regulatory analysis. Crypto declines don’t always mean losses—they can create earning opportunities. Long-term investors use crashes to buy assets at lower prices and sell at future highs. Traders leverage short selling to profit from falling prices, but must carefully assess risks. Ultimately, whether investing or trading, the key to success is accurate market analysis and strategic decision-making.

Back to articles

Back to articles