The world of digital currencies is incredibly diverse. Since the inception of the first cryptocurrency, this market has grown much faster and more actively than any other. Crypto attracts millions of users worldwide with its high earning potential and various income opportunities.

Indeed, you can earn from digital currencies in multiple ways, even without initial investments. Many modern cryptocurrency projects offer rewards for performing simple, sometimes everyday activities such as walking.

In this article, we will discuss what cryptocurrencies are, the different types, and how you can make money with them. We will examine traditional ways to make money such as trading and investing, as well as more unusual ways such as clicker games, coins for learning, or for walking.

Crypto in simple terms

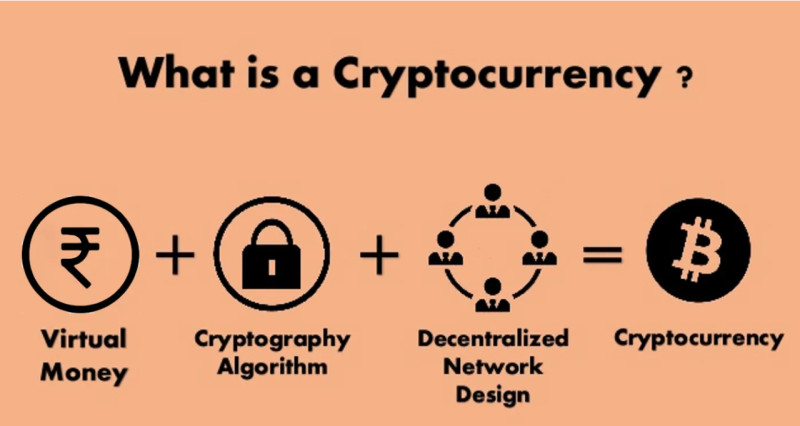

Cryptocurrency is an intangible asset, completely digital money that cannot be withdrawn from a card and put into a wallet. They exist only in the virtual world and have their own value, based primarily on people's trust in them.

Digital currencies were originally developed as an alternative to traditional money. The idea was to make payments and transfers, including international ones, with minimal fees and without intermediaries such as banks and other financial organizations.

Today, there is a wide range of cryptocurrencies, each with its own purpose and function. In addition to being used as a means of payment, there are tokens used in games, governance coins, and others.

Cryptocurrencies are based on a special data encryption technology called cryptography, hence the name of this asset. This technology is used not only in this field but also in many others, from creating simple ciphers to digital signatures.

Decentralization is achieved by storing all data not on a single centralized server like in banks but on many independent devices. These are called nodes, which perform computational work to keep the network running.

Digital currencies are not vulnerable to inflation because they have a pre-programmed number of units for each currency. Therefore, developers cannot produce additional coins to regulate the supply of a particular cryptocurrency.

The operation of any cryptocurrency is based on blockchain technology. This is a special method of recording and storing data that allows it to be stored securely and protected from hacking. We will discuss this technology in more detail later.

Types of cryptocurrencies

All digital currencies can be broadly divided into two categories: Bitcoin, which is the first cryptocurrency, and altcoins, which are alternative coins that emerged after BTC. However, there are other classifications, such as dividing cryptocurrencies into coins and tokens.

Below is a table outlining the key differences between coins and tokens:

| Parameter | Coin | Token |

| Own blockchain | Yes | No (created based on an existing blockchain) |

| Usage | Payment method, store of value, unit of account | Utility functions, governance functions, etc. |

| Compatibility | Limited to its own blockchain | Can be supported by various blockchains |

| Examples | BTC, ETH, DOGE | USDT, UNI, LINK |

Thus, all digital currencies have different functionalities and can be used for various purposes. Depending on their intended use, several categories of cryptocurrencies can be identified:

- Stablecoins – Their value is tied to a physical asset such as precious metals, securities, or fiat currency. The price of these coins does not fluctuate by more than 1% relative to the base asset, making them more stable.

- Security tokens – Also known as security tokens. They are digital analogs of securities that represent ownership rights of their holders over specific assets, typically company shares. Like stablecoins, their price is tied to the value of the underlying asset.

- Utility tokens – Provide access to services and features of the project they belong to. These are the project's internal currency used to pay for platform resources, transaction fees, etc.

- Governance tokens – Allow their holders to participate in the management and further development of the project through voting. This creates a loyal community of users interested in the project's development and promotion.

- NFTs – Non-fungible tokens that are unique and indivisible. Typically, these tokens represent digital images, music and literary works, collectible items, game characters, and other items in games.

- Privacy coins – Cryptocurrencies that ensure complete anonymity of transactions, with their origin and purpose completely hidden. Despite their appeal, such coins can also be used for criminal purposes such as money laundering.

Crypto and blockchain technology

Every transaction made with digital currencies is recorded in a special database, or more precisely, a distributed ledger. What does this mean, and how does it work? Let's figure it out in this section.

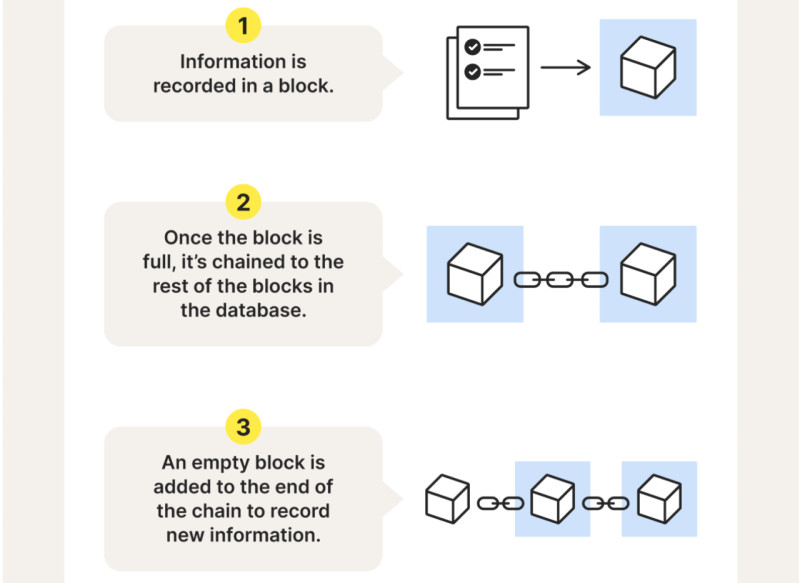

When any operation is performed with crypto, it is recorded on the blockchain. All information is stored in blocks that are then linked into a single chain (hence the name of this technology – blockchain).

Every record on the blockchain is immutable. This is because all data is stored not on one central server but on many independent devices. Consensus, or agreement, within the network is achieved through special mechanisms.

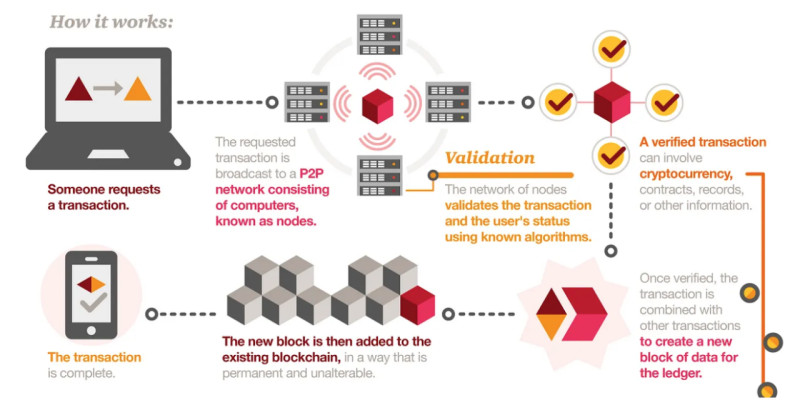

As mentioned earlier, computation is performed by nodes, which are individual devices connected to the network. A transaction is verified and added to the network by one node, but others must confirm the correctness of the data entered. This way, consensus is achieved in the chain, and the system automatically distributes the latest version of the ledger to all devices.

As a result, data storage on the blockchain has a high level of security. Even if criminals try to change information on one device, it will remain unchanged on all other devices. Attacking the blockchain would require access to more than 51% of the devices, which is virtually impossible.

Another aspect of reliability is that each block in the chain contains a reference to the previous one. Therefore, if it is necessary to change one block, all previous blocks must also be changed. This is because cryptographic hashes are added to the block along with transaction records.

It is the hash that links the blocks into a single chain. As soon as someone tries to change the contents of a block, either intentionally or accidentally, the hash value changes, which in turn makes it possible to detect an attempt to falsify data. Thus, each successive block strengthens the verification of previous ones and, in general, the network's reliability.

What is crypto and how does it work

Now that we have learned what cryptocurrency is and the technology behind it, it is time to understand how crypto works. Specifically, we will dive into the entire process of making transactions with digital currencies.

To perform any operations with coins, you need to register and create an account on an exchange or a platform. Exchanges are more reliable in this regard, but the registration process is also more complex, requiring verification and identity confirmation.

After creating an account, you need to fund it with fiat money. This can be done in any currency by choosing the most convenient method, such as using a bank card. Then, the fiat money is exchanged on the exchange, and the required amount of cryptocurrency is purchased.

To send a certain amount of coins to another user, you also need to open a crypto wallet. The sender initiates the transaction by entering the recipient's wallet address and the transfer amount. Transactions are signed with a public key and sent to the blockchain for verification.

The function of verifying transactions in various types of chains is performed by miners or validators. They check the authenticity of all entered information and the actual availability of the necessary amount of crypto for transfer in the sender's account. If all data is correct, the transaction is confirmed and recorded in the blockchain.

As mentioned above, all operations in the blockchain are immutable. Therefore, if there is an error in the recipient's address or the wrong network is chosen for data transfer, the coins will simply go "nowhere." They will not be credited to the recipient's account, nor will they be returned to the sender's account.

Two other essential elements in any crypto transaction are the public and private keys. The former is the wallet address to which the coins are sent. It consists of a randomly generated combination of letters and numbers and can be publicly accessible.

The private key is another randomly generated sequence. However, this combination must be kept secret because its loss can result in the loss of all the cryptocurrency in the wallet. It acts like a password for an account, providing access to the contents of your wallet.

What is crypto and how to make money with it

Since digital currencies are not yet recognized as legal tender in many countries, most users use them for other purposes. The primary goal is to earn crypto income, which can be achieved in various ways. We will discuss these methods in this and the following sections.

There are a number of ways to generate income using digital currencies. They all differ in potential profitability and risk levels. Each user can choose the method that suits them best.

- Trading involves making short-term speculative trades on the price movements of a particular cryptocurrency. For traders, every fluctuation, even the smallest, matters. They can profit from both price increases and decreases.

- Investing is a long-term capital investment in a particular crypto asset, expecting its value to increase over time. The goal is to profit only from price increases, so assets should be bought at the lowest possible price and sold at the highest, which takes a long time.

- Mining is the process of obtaining new coins. It is only available in chains that use the PoW consensus mechanism and is not available in others. Coins are awarded as a reward for verifying and adding transactions to the blockchain.

- Staking is a form of passive income. It is only available in networks that use the PoS consensus algorithm. Coins are locked in an account for a certain period and are used to support the chain's functioning, with their holder receiving rewards in the form of new coins.

- Airdrops are completely free tokens. Coins are distributed by developers as part of marketing campaigns and advertisements to attract more users and build a community of crypto enthusiasts around the project.

- Games and other activities: There are numerous crypto projects, each with its own goal. Projects with P2E (play-to-earn) and L2E (learn-to-earn) concepts are gaining popularity. The former involves games to earn income, while the latter involves education.

Where and how to trade cryptocurrency

Let's delve into various ways to generate income through digital currencies. We will start with trading, as it is the most sought-after and one of the most accessible methods. As noted above, cryptocurrency trading can be conducted on exchanges or other platforms.

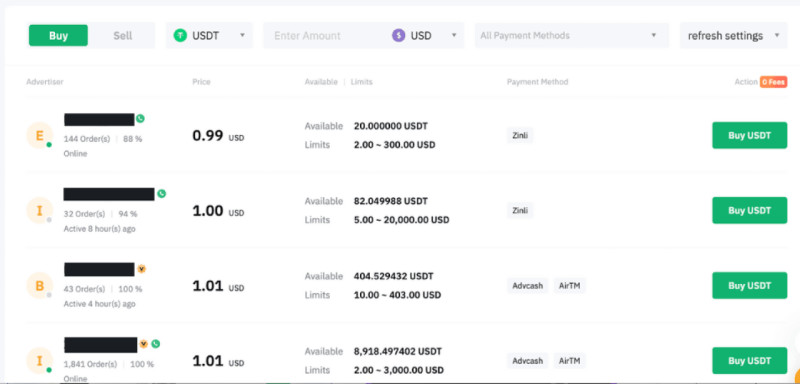

For example, on P2P (peer-to-peer) platforms, crypto is transferred directly from one user to another without an intermediary or regulator like an exchange. These platforms can be thought of as bulletin boards where users post buy and sell orders for cryptocurrencies.

Users must find a suitable counterpart to complete the transaction. The platform itself does not participate in these trades but merely allows users to find each other. If the transaction is confirmed by both parties, the offer is completed. If one party disagrees, they can open a dispute, which the platform resolves.

The primary way to make money on P2P platforms is through arbitrage. There are numerous such platforms, and cryptocurrency prices vary across them. Therefore, a user can buy coins at a lower price on one platform and sell them at a higher price on another similar platform, keeping the difference as profit.

On exchanges, speculative trades can be made to profit from a rise or fall in the price of a particular coin, but this requires thorough market analysis beforehand. If a trader believes that the price of a crypto asset will go up, they open a long position (buy). If they think it will go down, they open a short position (sell).

Trading on cryptocurrency exchanges is considered more reliable as all clients must undergo a verification process. P2P platforms do not have such rules, so there is a risk of encountering dishonest counterparties. Below is a comparison of exchanges and P2P platforms:

| Parameter | Exchange | P2P Platform |

| Transaction Method | With intermediary | Without intermediaries |

| Fee Size | Higher | Lower |

| Speed | Higher | Higher |

| Удобство | Higher | Lower |

| Reliability | Higher | Lower |

| Accessibility | Lower | Higher |

How to invest in digital currencies

Investing is another popular way to earn with digital currencies. To make money on investing, you need to invest capital correctly and predict which crypto will soar. Let's discuss how to choose crypto assets for investment and some other important rules.

Investing in digital currencies carries a much higher level of risk than other assets, but it also has potentially higher returns. It is crucial to follow certain rules to avoid losing all of your invested funds.

The most important rule for any investor is "don't put all your eggs in one basket," meaning that you should not invest all your capital in one asset. You should create an investment portfolio that includes assets with different levels of risk and potential returns in a specific ratio according to your risk profile.

Another rule is the proper selection of assets. There are many digital currencies, but not all of them can show significant price growth. Some may even disappear or turn out to be fraudulent projects.

Therefore, it is essential to check what is behind the cryptocurrency, the project's main idea, who the creators are, whether it has a website and social media accounts, the size of the project's community, and so on. These aspects will help distinguish a real cryptocurrency from a scam and identify the most interesting and promising crypto assets.

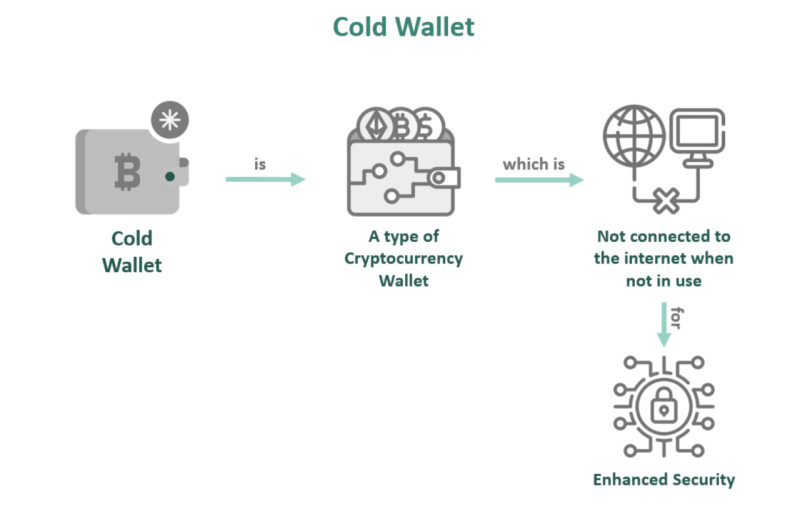

Another critical aspect is the storage of the digital assets purchased. Investing involves long-term capital investment, so the crypto might need to be stored for several months to several years. It's best to use "cold" wallets for this purpose. They are the most secure as they have no access to the Internet, making it harder for criminals to steal the coins.

Another rule implies that you should not invest the entire amount at once. When investing in cryptocurrencies, it is better to divide the sum into several parts and buy coins gradually and periodically. Monitor, which coins show growth and positive momentum, and increase their share in the portfolio.

By following these guidelines and choosing the right assets, investors can potentially generate significant returns from their cryptocurrency investments.

How to generate income with no initial investment

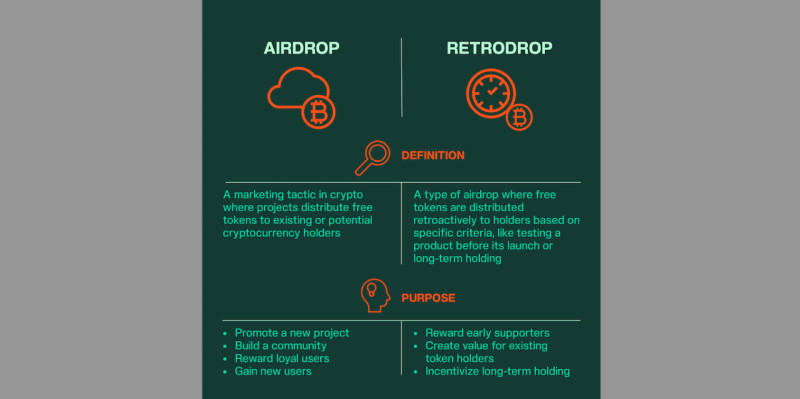

One of the ways to generate income that requires no initial investment from the user is through airdrops. Retrodrops are a specific type of airdrop. We will discuss this and other low-cost earning methods in this section.

Developers of new digital currencies aim to attract the attention of the crypto community and potential investors. To achieve this, they use various marketing tactics, one of which is airdrops, or the free distribution of coins in exchange for user activity and completing simple tasks.

Such tasks may include subscribing to the project's social media accounts, reposting publications, writing reviews, and so on. The terms may vary for different crypto projects. In general, the total reward is either divided equally among the participants or each receives a fixed amount of the currency.

The difference with retrodrops is that the reward in the form of digital coins is given only to the first users who were active at the project's initial launch. Often, the airdrop and its conditions are not announced in advance. The idea is to have users support the project without expecting a reward.

Therefore, coin distributions often come as a pleasant surprise to crypto enthusiasts who have supported the project from the beginning. Moreover, the reward volume in such cases is often much higher than during regular airdrops.

This allows each project to independently set conditions and select users who will receive the reward. However, one condition remains constant—active participation. The way this activity is measured depends on the specific cryptocurrency.

This method of making money on crypto seems quite attractive as it does not require any initial investment from the user. However, it also has its pitfalls: firstly, a user might not receive coins due to high competition; secondly, even if they receive tokens, there may be restrictions on selling them for a certain period

Interesting ways to earn

Let's continue exploring ways to earn digital currencies without investing your own money. As mentioned earlier, each cryptocurrency project has a specific goal that helps attract a particular audience. One such idea is earning crypto for steps, which rewards physical activity with cryptocurrency.

There are P2E (Play-to-Earn) projects that offer rewards for playing games. Users simply play blockchain games and receive rewards. Additionally, all acquired characters and other in-game items have real value as they can later be sold on special platforms.

The L2E (Learn-to-Earn) concept means earning rewards for learning. Educational projects teach users how to use digital currencies. Users complete training, confirm their knowledge through tests, and receive rewards.

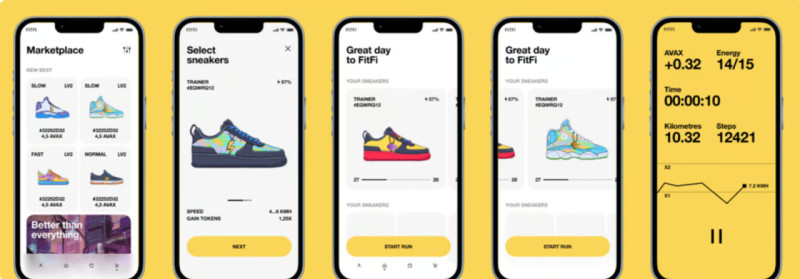

A newer but rapidly developing concept is M2E (Move-to-Earn), which rewards users for physical activity. To participate, users need to download a special app and acquire digital sneakers, represented as NFTs. These sneakers vary in features, type, level, and other attributes.

After meeting these requirements, users can engage in physical activities such as walking or running and earn in-game currency that can later be exchanged for real digital currency. This concept has both financial and social benefits as it motivates people to be more active.

It might seem straightforward: just walk and earn money. However, there are some limitations such as some apps setting a daily earning limit. Also, a stable GPS connection is required; if the signal is weak, results may not be recorded.

By understanding these concepts and exploring various options, users can find ways to earn digital currencies without the need for initial investments.

Popular earning methods

Continuing the topic of earning through digital currencies with minimal effort and no initial investment, let's discuss one of the most talked-about phenomena in the cryptocurrency space—Hamster Combat. There are few people who have not heard of or played this game.

There have been instances of people literally going crazy and staying up all night to collect all the rewards and maximize their profits in this game. The appeal of this game lies in its simplicity and accessibility, making it playable even for children.

The main premise of Hamster Combat is that the player, acting as the manager of a cryptocurrency exchange, must maximize its profitability. Players can earn in-game tokens by simply clicking on the hamster (the main character) or increase their passive income by completing various tasks and engaging in mining.

Passive income is credited every three hours, so players need to collect their earnings quickly. This is why many people have stayed up all night to collect their profits, earn more money, and make new purchases. The more purchases you make in the different mining sections, the higher your passive income will be, i.e. your profit per hour.

As the income increases, players can level up and unlock even more opportunities. In addition to the gaming aspect, the project has an educational component that teaches users the basics of investing and how to select assets with high potential returns.

Some bonuses and cards in the game are only unlocked after inviting a certain number of friends. This strategy has allowed the project to spread quickly around the world. Currently, the game has over 40 million active users.

Besides being an interesting and engaging game, players have another motivation. The developers have announced the potential listing of the project's cryptocurrency on a real exchange, allowing users to receive actual cryptocurrency in their wallets. However, it remains uncertain if and when this will happen.

Other crypto projects on Telegram

The aforementioned Hamster Combat project operates on the Telegram messenger, but it is not the only example. Let's explore how cryptocurrency appeared on Telegram and how some of the most well-known projects are developing.

Initially, Telegram developers, including Pavel Durov, who is also known for launching social network VKontakte, created the innovative Telegram Open Network (TON) blockchain. Its main goal was to enable fast blockchain transactions directly within the messenger application.

The key advantage of this chain is its sharding function, allowing multiple transactions to be processed simultaneously using subchains. This increases scalability, speeds up transactions, and reduces their cost.

Due to the growing popularity of the network, the project's native currency, TON, has become highly sought after. It can be used not only for transactions within the network but also as a governance token, allowing holders to participate in voting on chain management issues.

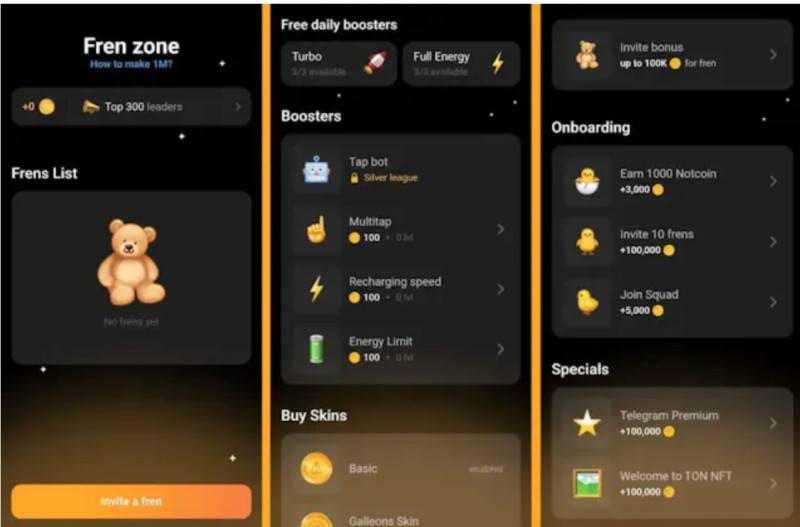

Another gaming project created on the TON platform is Notcoin, a Web3 game. The project started as a simple clicker game but evolved into something more significant, attracting a large audience to the blockchain. The NOT currency has already been listed, and users can convert their game tokens into real cryptocurrency.

Games like Notcoin and Hamster Combat are presented on Telegram as bots, making them very convenient and user-friendly. Playing these games is simple, but players can earn real money once the tokens are listed, which has already happened with Notcoin.

Furthermore, the messenger offers a wide range of services such as educational and informational channels that provide the latest data from the world of digital currencies. Telegram also has its own wallet, which supports several major coins, bots for making payments and transfers, and many other useful features.

How to withdraw earnings

We have discussed various ways to earn digital currencies. Now it is time to talk about how to legitimize and convert your earnings into fiat currency. Cryptocurrencies can be withdrawn through the same exchanges where they are purchased. Let's take a closer look at this process.

Despite the advantages of digital currencies, it is not always possible to use them in the real world as many companies do not accept crypto payments. Therefore, if a user manages to earn some income in coins, they can either reinvest it back into crypto again or convert it into real money and withdraw it.

The best way to exchange cryptocurrency for fiat money is to use a crypto exchange. You can also use P2P platforms or online exchangers. Additionally, there are crypto ATMs that can convert and withdraw funds, although the fees are quite high.

If your coins are stored in a cryptocurrency wallet, you will need to transfer them to the exchange before making the exchange. This is a quick and easy process that is almost instantaneous. Note, however, that the wallet service may charge a fee for withdrawals.

After converting digital currency into fiat money on the exchange, you can withdraw it to your bank account. This usually takes no more than one or two business days. Be aware that the exchange may charge conversion or withdrawal fees in addition to possible bank fees.

Another important aspect is the legalization of income obtained from digital currencies. In countries where cryptocurrency transactions are not prohibited, they are still subject to taxation. Typically, this means filing a declaration and paying income tax, which varies depending on the regulations of a specific country.

Conclusion

In this article, we explored what cryptocurrency is, the types of digital currencies, the technology behind them, and the most popular ways to earn with them. Cryptocurrencies have several characteristics that set them apart from traditional money: decentralization, security, and payment anonymity.

All cryptocurrencies are based on blockchain technology, which records all data in encrypted form in blocks that are then linked into a single chain. All information recorded in the blockchain is immutable, as changing one block would require changing all previous blocks.

Beyond transferring coins from one user to another, modern cryptocurrencies perform many other functions. Initially developed as a means of payment similar to national currencies, they are now used as utility tokens, security tokens, and more.

The most common ways to make money with crypto are trading and investing. The former involves short-term transactions based on changes in coin prices, while the latter involves long-term capital investment with the expectation that the value of crypto assets will increase over time.

Modern crypto projects offer many other ways to earn money. Concepts such as P2E (Play-to-Earn), L2E (Learn-to-Earn), and M2E (Move-to-Earn) are gaining popularity, allowing users to earn from playing, learning, and physical activity. In each of these projects, completing specific tasks earns in-game currency that can later be exchanged for real cryptocurrency.

Back to articles

Back to articles