Before understanding how crypto works, let's clarify what cryptocurrency is. In a nutshell, cryptocurrency is a digital form of money that exists entirely online and operates on blockchain technology.

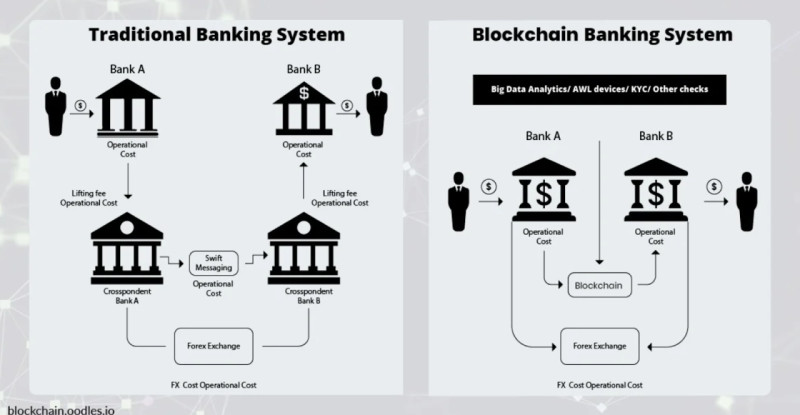

In the past, transferring money to another person required going through a bank or other financial intermediary. With the advent of cryptocurrencies, intermediaries are no longer necessary – transactions are conducted directly thanks to blockchain, a unique system composed of interconnected data blocks.

Initially, in some countries, cryptocurrencies could be used to buy a cup of cappuccino at a café. Later, it became possible to purchase airline tickets, and eventually, even pay for education.

For example, today at Lucian Blaga University in Romania, you can pay for tuition using cryptocurrencies.

Crowdfunding has also enabled the collection of significant amounts of money to implement unique projects and inventions.

But how exactly does crypto work, how does it function, and how does it differ from other payment methods, including electronic money? This article will thoroughly address these questions.

How cryptocurrencies emerged

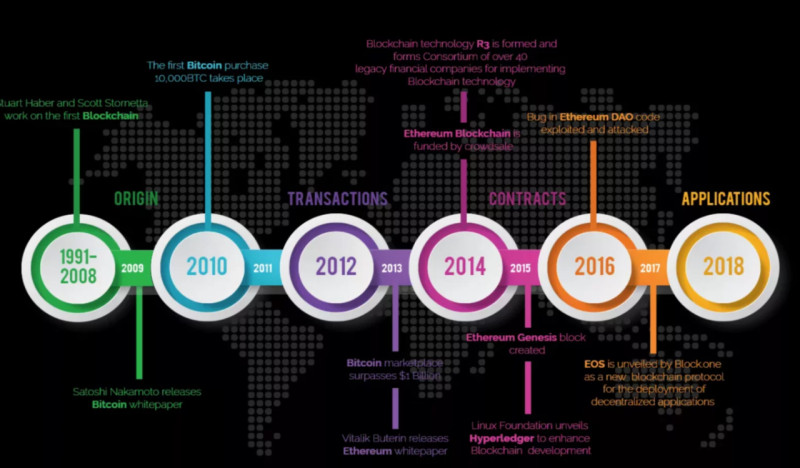

In 2009, the world saw the emergence of the first cryptocurrency – Bitcoin. However, the technologies that formed its foundation have older roots.

Even before Bitcoin, attempts were made to create digital currencies using encryption to protect ledgers. Projects like B-Money and Bit Gold were notable, though they were never implemented, their concepts were thoroughly described.

In 2008, the first mentions of Bitcoin appeared online. Someone using the pseudonym Satoshi Nakamoto published a document titled "Bitcoin – A Peer-to-Peer Electronic Cash System."

In 2009, Bitcoin was officially launched:

- On January 3, the first block containing 50 BTC was generated.

- On January 12, the first transaction on the network took place.

This marked the beginning of mining – the process of extracting new bitcoins.

With the growing popularity of decentralized and secure currencies, the first alternative cryptocurrencies – altcoins – emerged.

Most altcoins adopted Bitcoin’s core ideas but offered improvements such as faster transactions, enhanced anonymity, and other benefits. Notable altcoins include Namecoin and Litecoin, launched in 2009.

In 2015, the primary altcoin Ethereum was introduced, bringing innovations like smart contracts and Initial Coin Offerings (ICO). Ethereum’s platform quickly gained popularity, and by 2016, it was close to surpassing Bitcoin in significance.

In 2017, the leading cryptocurrency reached a record price of $10,000 and continued its rapid rally. The number of places accepting Bitcoin for payments increased, and a new wave of interest drove up BTC market quotes.

As a result, the cryptocurrency ecosystem experienced a substantial influx of capital, and the market capitalization surged. International banks and large organizations entered the scene, marking the start of a new financial era.

However, this rapid growth ended with the crash of 2018. In the first quarter, most cryptocurrencies sharply lost value. For example, from January 6 to February 6, Bitcoin dropped by 65%. Consequently, 2018 became a year of disappointment for many investors and a period of deep crisis for the industry.

Nevertheless, 2019 marked a turning point, as cryptocurrency transitioned from the shadows into a key part of the global financial system. In the spring, cryptocurrencies began to rise again, with Binance Coin – the internal token of one of the largest exchanges, Binance – leading the growth.

Thus, cryptocurrencies started integrating into the global financial system, gaining wide recognition.

From 2020 onward, a new phase of cryptocurrency growth began. Large institutional investors and billionaires started actively investing in the market.

A significant growth factor was Bitcoin halving in May 2020, which reduced the mining reward from 12.5 to 6.25 BTC.

Cryptocurrencies vs. fiat money

To understand how crypto works, let's explore its main differences from the traditional money we are accustomed to.

First, let’s discuss the similarities. Cryptocurrencies and fiat money share several common features:

- Both forms of money are used for payments and as a store of value.

- The functionality of both relies on user trust.

However, cryptocurrencies offer unique capabilities that traditional monetary systems cannot yet provide, which is why they are often proudly referred to as the "currency of the future."

The key advantage of digital money lies in its decentralization. Cryptocurrency is not subject to control by the government or any centralized authority, allowing people to conduct direct transactions without intermediaries.

In contrast, fiat money is fully controlled by governments and banks, with no anonymity or privacy.

Fiat money (or commodity money) holds value solely because the state recognizes it as legal tender. It has no intrinsic value.

On the other hand, cryptocurrencies can be used to pay for goods anywhere in the world, at any time, without the involvement of banks or government institutions.

At the same time, fiat money is subject to state control, allowing governments to print as much as they desire. Cryptocurrencies, however, operate according to rules established by mathematical calculations and user agreements.

Bitcoin introduced a new level of trust in the financial system. Its decentralized model is transparent and based on mathematical algorithms. With all their advantages, cryptocurrencies can be considered the next step in the evolution of financial systems.

Forms of cryptocurrencies

Digital currencies are divided into coins and tokens, and although these terms are often confused, they have fundamental differences. Let's break down how coins differ from tokens.

Coins represent the primary currency of a crypto project and operate on their own blockchain. They are obtained through mining and can be used to transfer to other users, pay for goods and services, and exchange for fiat money.

Any cryptocurrency other than Bitcoin is referred to as an altcoin.

Tokens, on the other hand, are digital units that function on an already existing blockchain. They cannot be mined like coins – they can only be acquired or earned as a reward for specific actions.

Tokens are not typically used to pay for goods or services. Their primary role is to provide access to the functions of a crypto platform. Additionally, they serve as investment tools and allow participation in voting and surveys.

To exchange tokens for fiat or other cryptocurrencies, they must be traded on an exchange. Unlike coins, which operate on the Bitcoin blockchain, most tokens function on the Ethereum platform.

To draw a real-world analogy, coins can be seen as cash, while tokens are like tickets granting access to specific features or services.

Types of cryptocurrencies

There are three main types of cryptocurrencies:

| Decentralized сryptocurrencies | Created and managed through mining. Examples include Bitcoin, Ethereum, Zilliqa, Elastos, and IOTA. Their key feature is that they operate on blockchain technology, allowing them to avoid centralized control. |

| Centralized сryptocurrencies | Although they also use blockchain technology, their issuance and management are controlled by a closed group of individuals. These currencies are not mined – they can only be purchased. Examples include Bitcoin Cash, Ripple, TRON, and EOS. The organization managing these cryptocurrencies can control and, if necessary, block user accounts. |

| Stablecoins | These currencies are pegged to a real-world asset, most commonly a national currency or another cryptocurrency, making their value less volatile. Examples include Gemini Dollar (pegged to the US dollar) and DigixDAO (pegged to a gram of gold). Stablecoins backed by national currencies are typically centralized. For example, Tether (USDT), issued by Tether Limited, is backed by 20% US dollar reserves. Meanwhile, Gemini Dollar is fully backed and regulated by the New York State Department of Financial Services. |

How to obtain cryptocurrency

You need a digital wallet to store cryptocurrency, such as coins or tokens. There are several ways to fund this wallet.

| Mining | Mining is the process of creating new blocks in the network, for which miners receive rewards. To participate in mining, users need to provide their computing power. Specialized equipment – mining farms – can be used for this. Users can pool their computing power to create mining pools for joint mining efforts. |

| Staking | In staking, the process depends on the amount of coins a user already holds. It functions as a form of investment: the owner locks their coins to support the blockchain and earns rewards in return. |

| Purchase | Cryptocurrencies can be purchased through exchangers where users trade digital coins for other cryptocurrencies or fiat currencies. A commission is charged for exchange services. Alternatively, P2P exchanges enable direct transactions between individuals without intermediaries. These platforms often require identity verification through documentation. Cryptocurrencies can also be purchased on crypto trading platforms (exchanges). |

| Trading | Crypto trading is similar to traditional trading and is based on the principle of "buy low, sell high." High cryptocurrency volatility allows for rapid transactions. Trading takes place on specialized platforms. Tokens can be acquired through exchanges, online exchange platforms, or directly from companies offering shares in project profits in exchange for token purchases. Payments can be made in fiat currency or cryptocurrency. |

More about blockchain

When you make a bank transfer (or any other financial transaction), the bank does not immediately deduct funds from your account and transfer them to the recipient.

Instead, the bank records the payment information in its internal database, adjusting the balances in your account and the recipient's, if necessary. The actual movement of money happens not physically but through record changes in these databases.

How does crypto work?

For cryptocurrencies to operate without centralized intermediaries, there must be a method to record and store all financial transactions to avoid the issue of double spending.

This means that the same cryptographic token cannot be spent twice, preventing someone from "purchasing" goods worth more than their balance.

The solution must work without the use of a central server or database, as banks typically do.

Most cryptocurrencies use a distributed ledger protected by cryptographic methods, known as blockchain.

A blockchain is a sequence of blocks containing records of transactions. These blocks are linked to one another and secured using cryptography. Each block has a unique cryptographic identifier that links it to the previous block in the chain.

Once a block is added to the blockchain, altering it is impossible without modifying the data of the entire subsequent chain. This immediately signals other users about the interference attempt, and the altered version of the chain is rejected since it cannot be validated without the consensus of the majority. As a result, everyone continues using the original blockchain.

Digital wallets for cryptocurrencies can be integrated with the blockchain to verify balance accuracy and validate new transactions using blockchain data.

This ensures that each transaction is legitimate and carried out by cryptocurrency genuinely owned by the user (or their wallet).

More about mining

To agree on which blocks of transactions should be added to the blockchain and how to create them, some network participants engage in a process known as mining.

The term "mining" refers to the use of computing power to perform complicated tasks. However, it is important to understand that using cryptocurrency does not require mining it.

Miners perform complex mathematical calculations using powerful computing systems to complete what is known as Proof-of-Work (PoW).

This method ensures blockchain security and prevents various attacks, such as record forgery, transaction refusal, or spam.

Mining has become quite expensive today, especially for leading cryptocurrencies like Bitcoin. Individual users cannot simply start adding their blocks to the blockchain without the approval of the entire network; otherwise, their blocks will not be recognized.

Significant changes to the blockchain are only possible if one party controls 51% of the computing power, resulting in the creation of a new version of the blockchain – a fork.

This has occurred multiple times over the nearly ten-year existence of blockchain technology.

A fork can coexist alongside the original chain but will not be compatible with it.

Cryptocurrency wallets

Cryptocurrencies are not stored in conventional bank accounts like regular money. Instead, users manage their digital assets through software and hardware wallets.

Each wallet is equipped with a unique cryptographic key, providing access to funds stored in the public blockchain.

Wallets can be:

- Hot wallets are connected to the internet through online services (e.g., Coinbase).

- Cold wallets are stored offline.

A cold wallet is a file on your computer or removable storage device. Losing this device can result in permanent loss of access to the wallet and its contents.

Some startups offer physical devices, such as keychain wallets, which are additionally protected by a PIN code for enhanced security.

10 ways to use cryptocurrencies

To demonstrate how crypto works in practice, here are 10 ways to utilize cryptocurrencies to achieve various goals:

- Long-term investments in cryptocurrencies

This strategy relies on the assumption that the value of cryptocurrencies with limited supply will grow over time.

Bitcoin, with its long history and stable issuance rules, is an optimal choice for long-term investments.

Users purchase Bitcoin with fiat money and hold it until its value reaches the desired level.

2. Investing in tokens and NFTs

This involves betting on the rising value of purchased tokens or NFTs.

Tokens are often bought using the cryptocurrency on which they are based, typically Ethereum.

3. Crypto deposits

Using various platforms for staking and lending allows users to place cryptocurrencies in deposits or lock them to earn interest in the same digital currency.

This method applies to most cryptocurrencies, including stablecoins.

Both centralized and decentralized (DeFi) platforms offer such services.

4. Loans backed by cryptocurrency

This solution benefits investors who do not want to sell their cryptocurrency assets but need cash.

They can pledge their cryptocurrency, receive stablecoins, and pay regular interest on the loan.

5. Trading

Trading cryptocurrencies on exchanges follows the principle of "buy low – sell high."

This strategy suits currencies with high volatility.

6. Money transfers

Cryptocurrencies enable large money transfers, including international payments, without involving banks or their oversight.

This minimizes the risk of account freezes and taxation of received funds.

The most decentralized cryptocurrencies, such as Bitcoin, are ideal for this. Stablecoins may involve address-blocking features.

7. Holding funds without risk of freezing

Cryptocurrencies allow users to store money without fear of bank account freezing at the request of government authorities.

Again, decentralized cryptocurrencies are preferred for this use case.

8. Paying for goods and services

Cryptocurrencies can be used to purchase items when traditional payment methods are unavailable.

This is particularly useful for individuals under sanctions or those who prefer direct cryptocurrency payments without converting to fiat.

9. Donations and charity

Cryptocurrencies are perfect for anonymous donations, preserving the donor’s privacy.

10. Salaries

In some cases, paying salaries in cryptocurrency is the easiest or most convenient option for employees abroad. This is especially true for companies operating in the crypto industry or earning revenue in digital assets.

Employees preferring direct payment in cryptocurrency also benefit from this approach.

Why use cryptocurrencies?

Thanks to their accessibility, low fees, potentially high transaction speeds, and the ability to remain anonymous, cryptocurrencies are increasingly being adopted across various sectors.

As more small businesses, large corporations, and even entire nations begin to utilize cryptocurrency, it is expected to become a new standard in financial operations.

However, despite the clear advantages of cryptocurrencies, their widespread adoption faces several significant challenges:

- Lack of public understanding of the technology;

- Absence of regulations for cryptocurrency transactions and smart contracts;

- The legal uncertainty surrounding cryptocurrencies;

- Technical issues and limitations.

In some countries, legal issues have been partially resolved, but difficulties in integrating blockchain technologies and the lack of specialized business products remain major barriers.

Conclusion. Crypto: how it works

Cryptocurrencies represent a unique category of alternative money. They differ from traditional financial instruments by being independent of government structures or centralized organizations, making them decentralized.

It operates on a peer-to-peer (P2P) model, allowing users to exchange goods and services directly without the involvement of banks or intermediaries.

Although many cryptocurrencies offer anonymity, this is not always a defining feature.

Cryptocurrencies are built on common technologies and principles that facilitate the management of payment systems and control over transactions between users and financial institutions.

The primary uses of cryptocurrencies include:

- Paying for goods and services;

- Trading;

- Investing;

- Conducting operations within decentralized finance (DeFi) systems, where cryptocurrencies are used for various financial transactions without intermediaries.

Back to articles

Back to articles