Analysis of Trades and Tips for Trading the Japanese Yen

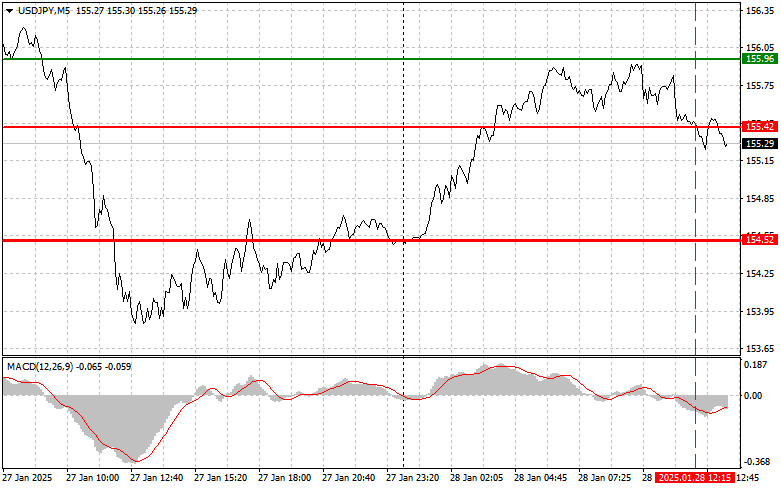

The 155.42 price test occurred at a time when the MACD indicator had moved significantly below the zero mark, which, in my opinion, limited the pair's downward potential. For this reason, I did not sell the dollar.

The yen has regained some ground against the dollar, but the market still favors USD/JPY buyers. In a recent interview, former Bank of Japan board member Sakurai stated that he expects a rate hike in June or July as Japan's economy recovers. Essentially, he reaffirmed the central bank's recently adopted course toward stabilizing monetary policy. Sakurai highlighted that Japan's improving economic conditions are tied to rising exports and increased consumer demand. These positive changes provide a foundation for revising the current interest rate policy, which has remained historically accommodative for several years. Sakurai emphasized that a rate hike would be an important step toward normalization, boosting investor confidence in the Japanese economy. However, he urged caution, pointing out that growth dynamics must remain sustainable. He also mentioned potential short-term impacts from global market slowdowns, which could pressure Japan, especially given the uncertainty surrounding Donald Trump's future policies.

Today, the US will release consumer confidence data, strong results of which could drive USD/JPY higher, as well as reports on durable goods orders and the Richmond Fed manufacturing index.

As for the intraday strategy, I will primarily rely on the implementation of Scenario #1 and Scenario #2 to continue the downward trend.

Buy Signal

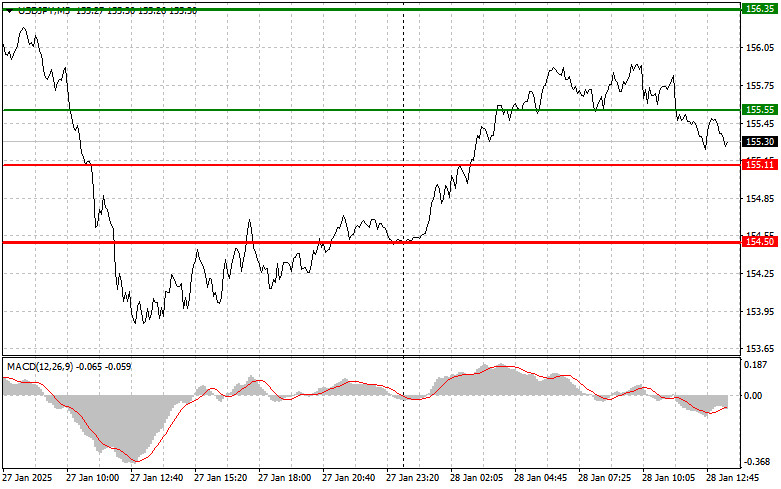

Scenario #1: Today, I plan to buy USD/JPY if the price reaches the 155.55 level (green line on the chart), aiming for a rise toward 156.35 (thicker green line on the chart). At 156.35, I plan to exit purchases and open short positions in the opposite direction (expecting a movement of 30–35 points from the entry level). The pair's growth potential depends on strong US statistics.Important: Before buying, ensure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: Another opportunity to buy USD/JPY will arise after two consecutive tests of the 155.11 level, provided the MACD indicator is in the oversold area. This will limit the pair's downward potential and trigger a market reversal upward. The expected growth will target 155.55 and 156.35.

Sell Signal

Scenario #1: Today, I plan to sell USD/JPY after a break below the 155.11 level (red line on the chart), which could lead to a rapid decline in the pair. The key target for sellers will be 154.50, where I plan to exit shorts and immediately open long positions in the opposite direction (expecting a movement of 20–25 points from the entry level). Further pressure on the pair is possible, but it would require a fundamental catalyst.Important: Before selling, ensure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: Another selling opportunity will arise after two consecutive tests of the 155.55 level, provided the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a market reversal downward. The expected decline will target 155.11 and 154.50.

Chart Key:

- Thin Green Line: The price level for entering long positions.

- Thick Green Line: The suggested price for placing Take Profit or manually closing a trade, as further growth beyond this level is unlikely.

- Thin Red Line: The price level for entering short positions.

- Thick Red Line: The suggested price for placing Take Profit or manually closing a trade, as further decline beyond this level is unlikely.

- MACD Indicator: Use it to determine oversold and overbought conditions before entering the market.

Important: Beginner Forex traders must be cautious when making market entry decisions. Before the release of critical fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set Stop Loss orders to minimize losses. Without Stop Losses, you can quickly lose your entire deposit, especially when trading large volumes without proper money management.

And remember: for successful trading, it is essential to have a clear trading plan, like the one provided above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.