On Tuesday, the GBP/USD currency pair experienced minimal movement for most of the day. It seemed that market participants had exhausted their willingness to open new trades after Monday's activity. There was little news on Tuesday, and Trump's actions neither surprised, alarmed, nor engaged the markets this time. Consequently, the focus of the currency market briefly shifted from politics to economic factors. It's important to note that the Bank of England is scheduled to meet this week, and the U.S. will release a significant amount of key macroeconomic data.

Some of this data has already started to come in; however, it went largely unnoticed on Monday. For instance, the ISM Manufacturing PMI for January was published in the U.S., showing a higher reading than anticipated. Typically, this report would prompt a notable increase in the U.S. dollar, but the market was too focused on Trump's decisions to pay attention to the economic data.

Looking ahead, before the week concludes, we will also receive reports on ISM Services PMI, ADP employment data, unemployment figures, and Non-Farm Payrolls, among other important reports. If this data comes in weaker than expected, the dollar could continue its downward trend, which technically began on Monday. However, this wouldn't come as a surprise since the upward correction on the daily timeframe still appears relatively weak.

Returning to the Bank of England's meeting, it seems likely that the British central bank will cut interest rates. The key question remains: what signals will Andrew Bailey send to the market? It is important to note that the UK economy is in a situation no better than that of the Eurozone. The European Central Bank has already cut rates multiple times and plans to bring them to a "neutral" level by summer. In the latter half of the year, we do not rule out further rate cuts by the ECB, as the economy requires stimulation. Consequently, the BoE may follow a similar path in 2025. Currently, the market anticipates four rate cuts, but there may be even more in reality. At the same time, rising inflation in the U.S., driven by Trump's tariffs, could compel the Federal Reserve to pause monetary easing this year. This is yet another factor that could push the GBP/USD pair lower.

Thus, we firmly believe that the downtrend, which began four months ago, is far from over. Additionally, we do not think that the 16-year trend has concluded. Corrections typically last longer than trend movements, so this correction may continue for a few more weeks or even a couple of months. Consequently, the British pound could see some upward movement in the medium term, but this does not indicate a change in the fundamental backdrop or that the overall trend has reversed. We still expect the pound to decrease, at least towards the $1.18 area.

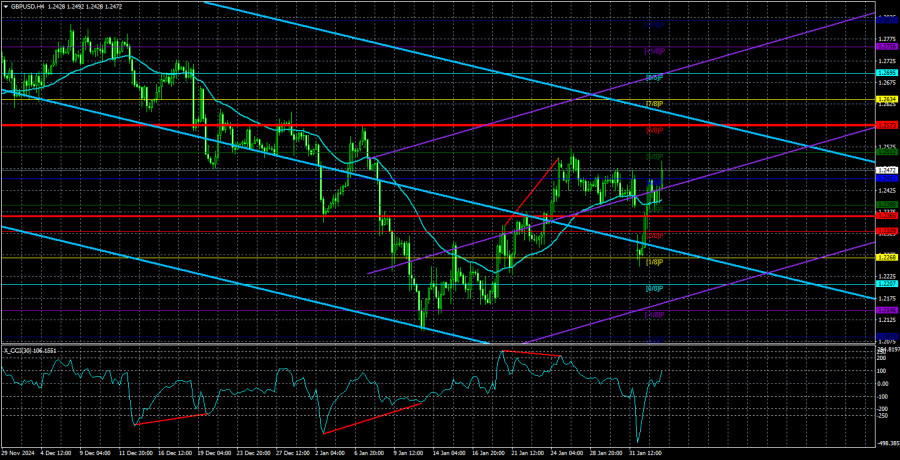

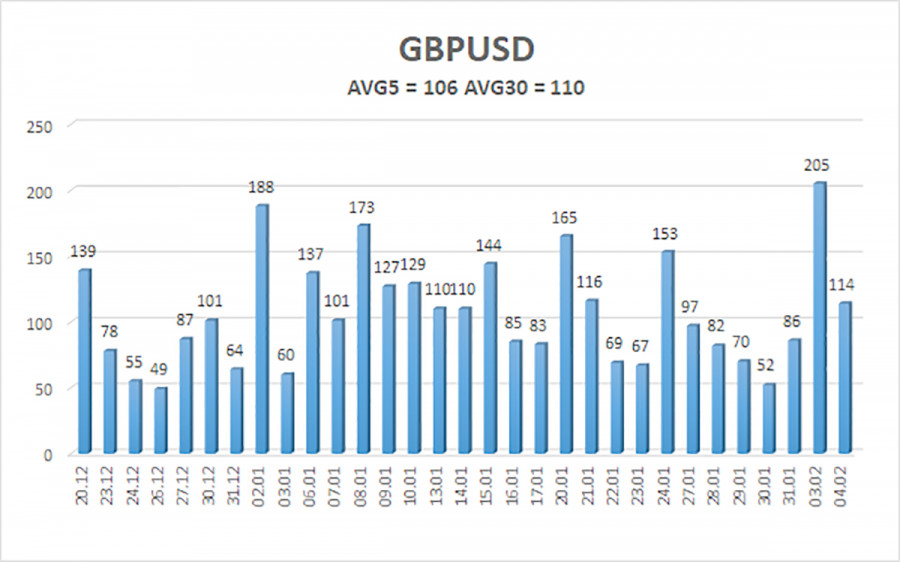

The average volatility of the GBP/USD pair over the past five trading days is 106 pips, which is considered "average" for this currency pair. Therefore, on Wednesday, February 5, we expect movement within a range defined by the levels 1.2365 and 1.2575. The higher linear regression channel is trending downward, signaling a bearish trend. The CCI indicator has entered the oversold zone, suggesting that a new upward correction is expected.

Nearest Support Levels:

- S1 – 1.2451

- S2 – 1.2390

- S3 – 1.2329

Nearest Resistance Levels:

- R1 – 1.2512

- R2 – 1.2573

- R3 – 1.2634

Trading Recommendations:

The GBP/USD currency pair is currently in a medium-term downtrend. We do not recommend taking long positions at this time, as we believe that the market has already priced in all factors that could support the growth of the British pound, and there are no new catalysts for further increases.

For those who base their trades purely on technical analysis, long positions could be considered with targets set at 1.2512 and 1.2573, as long as the price remains above the moving average. On the other hand, sell orders are more relevant, with initial target levels at 1.2307 and 1.2268. However, it is crucial for the price to confirm the upward correction on the daily timeframe.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.