Analysis of Trades and Trading Tips for the British Pound

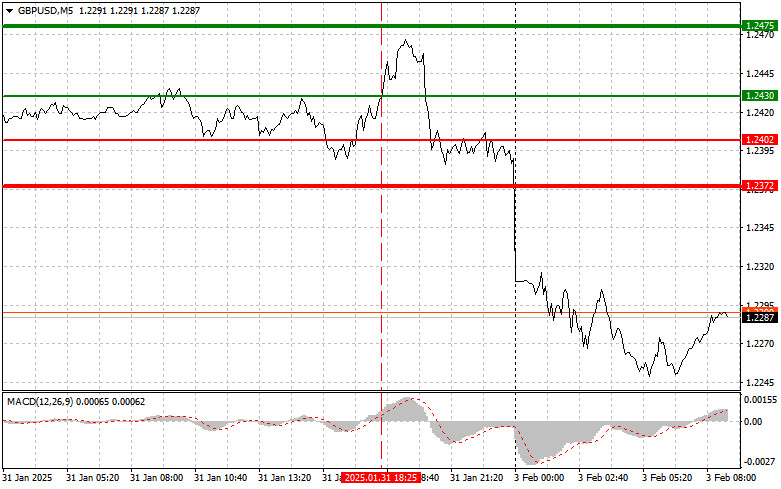

The test of the 1.2430 price level occurred when the MACD indicator had moved significantly above the zero mark, limiting further upward potential. As a result, I decided against buying the pound, as I did not identify any other entry points into the market.

The introduction of new trade tariffs came as an unexpected blow to global markets that were already under pressure. Investors from other countries, despite not being directly affected by the tariffs, began to panic, leading to a mass sell-off, including the British pound.

If tariffs are imposed on the UK as well, the Bank of England may be forced to reconsider its monetary policy in a more dovish direction, given the current state of the economy. Increased uncertainty on the international stage also poses risks for the growth of the British economy, which could impact consumer demand and investments. It is crucial to monitor how markets fluctuate and how countries like China, Canada, and Mexico will respond to the new tariffs.

Today, the UK Manufacturing PMI data will be released. However, even if the figures are positive, it is unlikely that they will significantly boost demand for the British pound. While the PMI reflects the health of the manufacturing sector and may exhibit some positive trends, the current economic context suggests that even favorable results are unlikely to have a strong impact on the pound's demand. Overall economic instability, driven by both global and domestic shifts, continues to weigh heavily on the currency.

Several factors contribute to this unfavorable environment, including rising inflation, unstable supply chains, and uncertainty surrounding U.S. tariffs on other countries. In this context, even a positive PMI reading may be approached with caution, especially if other indicators do not confirm the improving trend.

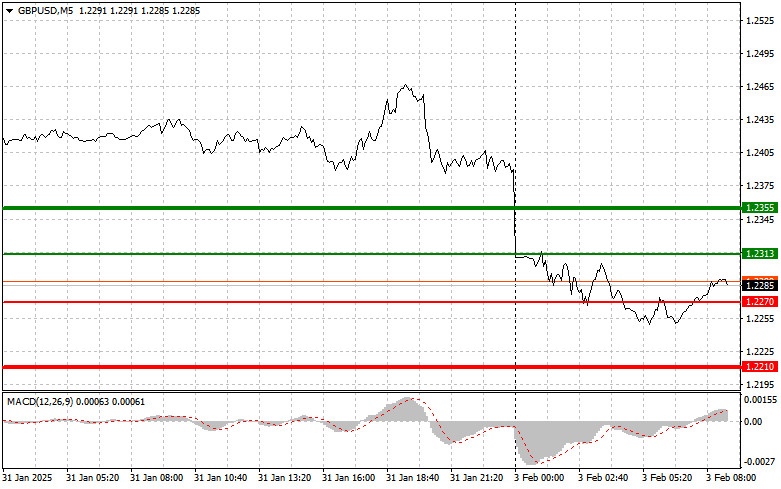

As for the intraday strategy, I will primarily focus on implementing scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the pound when the entry point reaches around 1.2313 (green line on the chart) with a target of rising to 1.2355 (thicker green line on the chart). Around 1.2355, I plan to exit long positions and open short positions in the opposite direction, aiming for a 30-35 pip reversal from the entry level.It is unlikely that the pound will experience significant growth in the near term. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.2270 price level when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Expect growth towards the opposite levels of 1.2313 and 1.2355.

Sell Signal

Scenario #1: I plan to sell the pound today after breaking below the 1.2270 level (red line on the chart), which will lead to a quick decline of the pair. The key target for sellers will be the 1.2210 level, where I plan to exit short positions and immediately open long positions in the opposite direction, aiming for a 20-25 pip reversal from the level. Selling the pound at higher levels is better for developing a new downward trend. Important! Before selling, make sure the MACD indicator is below the zero mark and starting to decline from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2313 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. Expect a decline towards the opposite levels of 1.2270 and 1.2210.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.